A new report on global app revenue growth in Q1, 2022 by Sensor Tower reveals that iOS App Store was flat growth in the first quarter of this year. However, the app usage saw approximately 5% growth. The slow growth rate is attributed to the normalization of the mobile market in the post-Covid-19 pandemic era.

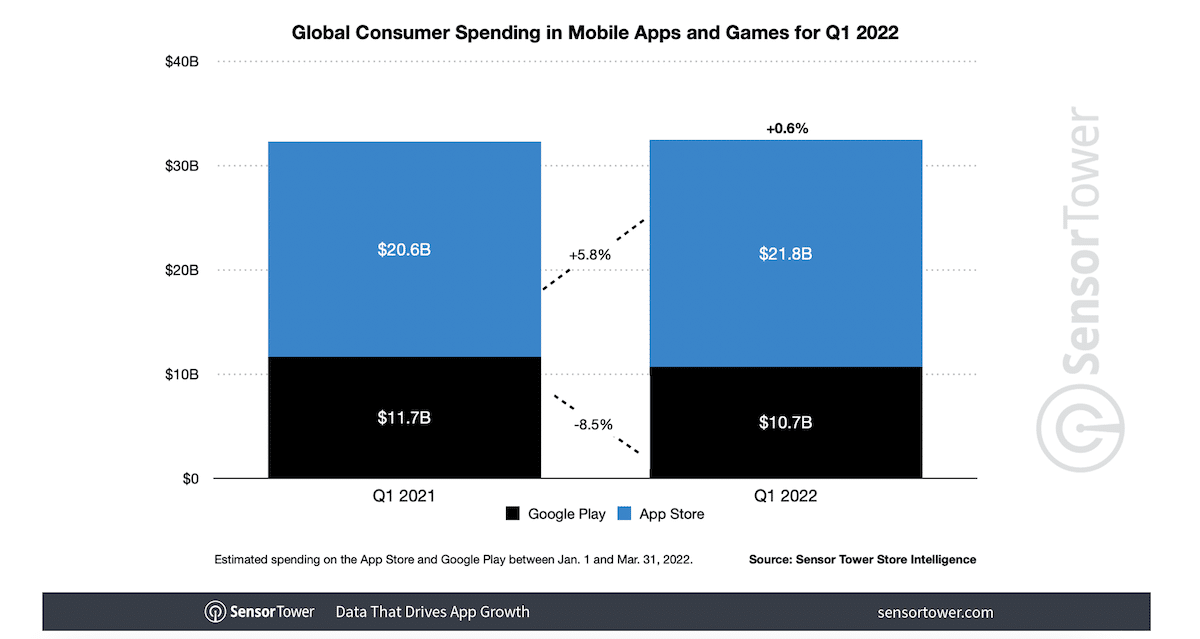

Consumer spending on in-app purchases, subscriptions, and premium apps and mobile games on iOS App Store remained flat for the same quarter the previous year, worldwide. In Q1, 2022, Apple’s digital marketplace generated $32.5 billion with only up 0.6% growth from $32.3 billion in Q1, 2021.

TikTok was the top-grossing non-game app on the App Store with $821 million in consumer spending in Q1, 2022, and the top three grossing mobile games on iOS App Store were:

- Tencent’s Honor of Kings $735.4 million

- PUBG Mobile $643 million

- MiHoYo’s Genshin Impact came in third with $551 million in player spending.

Having said that, App Store revenue for Q1, 2022 was more than double Google Play Store’s $11.7 billion with an 8.5% decline from $11.7 billion in Q1, 2021. Furthermore, new app usage trends also emerged for the aforementioned quarter.

New consumer usage trends emerge on App Store in post-Covid pandemic Q1, 2022

Explaining the latest global usage trends, the reports states that in Q1, 2022 Medical apps captured the top spot with the highest Y-o-Y growth in usage, followed by Navigation apps in second place and Travel apps in third place. And mobile games saw the largest 3.8% decline in usage compared to Q1, 2021.

The uptick in Navigation and Travel app usage in 1Q22 can be attributed to consumers making more trips now that the pandemic is somewhat controlled in parts of the world. The increase in MAUs among the top Medical apps was mainly driven by a surge in usage of COVID-related apps such as Indonesia’s PeduliLindungi, South Korea’s vaccine passport app COOV, and Brazil’s Conecte SUS. It could also be a result of users becoming acclimated to turning to mobile devices for such purposes.

Commenting on the current mobile market growth, the report details that the slow growth represents the normalization of the market post the Covid-19 pandemic.

Compared to the double digit percentage growth experienced by both stores in 2021, spending growth slowed in the first quarter of 2022. This represents a normalization in the market following supercharged growth during the onset of COVID-19, as well as slowed spending possibly due to factors such as a rising cost of living.

However, the categories that saw a boost due to COVID-19 have continued to see their usage climb Y/Y.

Read More: