Some Apple Card users have discovered that their card is now appearing on Experian Credit reports. Experian is a consumer credit reporting company which collects and aggregates users credit card information.

Experian is one of three credit reporting bureaus in the United States: Equifax, Experian, and TransUnion. Currently, Experian reports on credit card information of 235 million consumers and 25 million businesses in the United States.

Apple Card users shared this discovery on Reddit, a popular social media platform, and found out that not all Apple Card holders saw their creditor additions on the Experian credit reports which means that the new credit reporting may be rolling out gradually.

Neither Apple nor Goldman Sachs have commented on the discovery yet. Since December 2019, cardholders’ information was only reported by TransUnion.

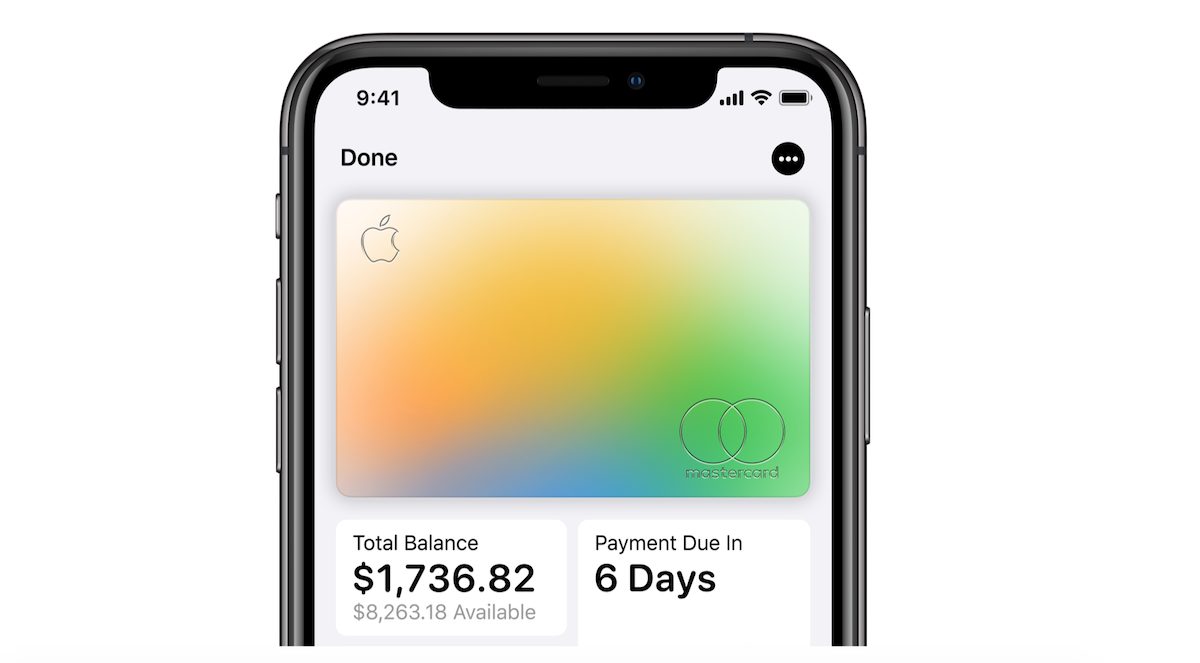

Apple Card

Just like its other products, the iPhone maker has recently updated Apple Card with new features. Last month, the company finally introduced a web portal for its cardholders to manage and track their billings and new cardholders were given a limited time offer of $50 cashback on purchase of any Apple service. Apple also extended deferred payments three times since the breakout of COVID-19 pandemic in March, and is expected to release a new monthly installment plan for more of its products.

During its Q1 2020 revenue call, CEO Tim Cook said that Apple Card’s 0% interest financing will be extended to other products soon. Currently, cardholders can purchase a new iPhone on 0%interest. The inclusion of more products in a 0% interest financial program might increase the value of Apple Card and be successful in attracting more consumers. iPhone users in the United States can easily apply for an Apple Card via their Wallet app.

Credit card reports show the record of users card, loans, and other payments, all of which is accredited to their credit score which is calculated based on timely repayments. Users in the United States can easily check their credit reports for free on Experian.com, Transunion.com, and Equifax.com.

2 comments