Apple Card and its issuer Goldman Sachs have been ranked the highest in the Midsize Credit Card Issuer segment of the annual J.D. Power U.S. Credit Card Satisfaction Study for the second year in a row. This is a big feat for the Apple Card as it was only announced three years ago.

Apple Card gets another feather in its cap due to new customer satisfaction survey

In addition to being ranked number one in customer satisfaction, Apple Card and Goldman Sachs also ranked highest across all of the surveyed categories in the Midsize Credit Card Issuer segment including interaction, credit card terms, communication, benefits, and services, rewards, and key moments, the tech giant revealed in its announcement post.

“Enhancing our customers’ lives is at the heart of what we do, so we are honored to have Apple Card and issuer Goldman Sachs recognized again this year for customer satisfaction,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “We remain committed to providing a digital-first credit card that helps customers lead healthier financial lives, and we look forward to continuing to deliver innovative financial tools and award-winning customer satisfaction to our Apple Card users.”

In related news, Apple Card partner Goldman Sachs is under investigation by the Consumer Financial Protection Bureau (CFPB). The regulator is looking into Goldman Sach’s ”account management practices, including with respect to the application of refunds, crediting of nonconforming payments, billing error resolution, advertisements, and reporting to credit bureaus,” after numerous customer complaints. Specifically, complaints filed by Apple Card holders.

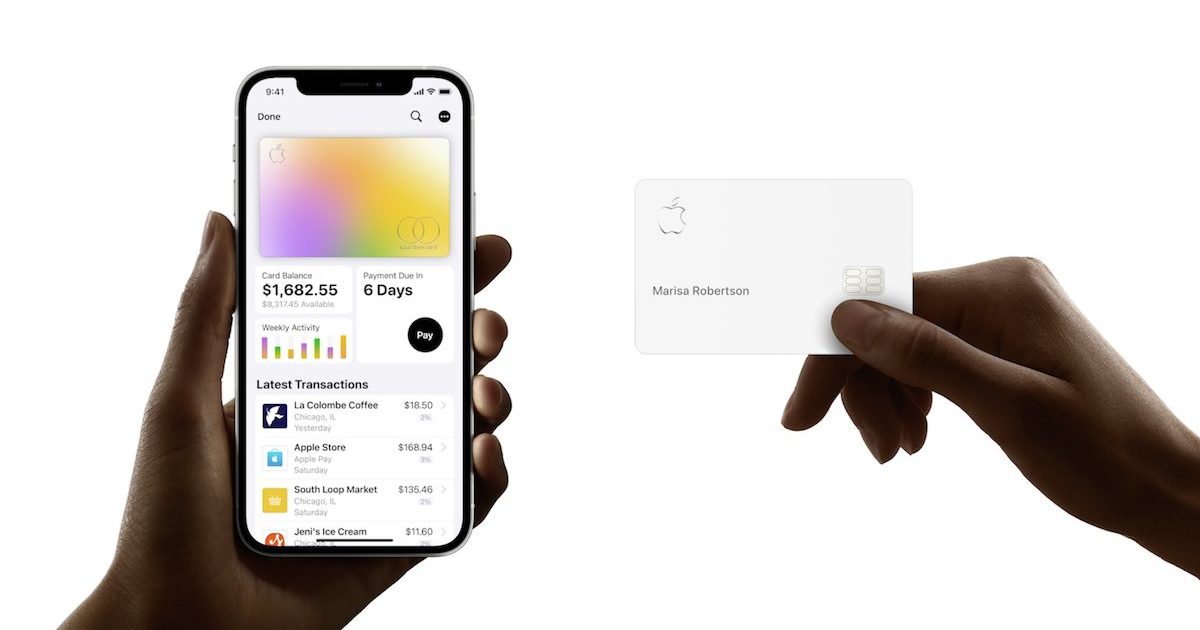

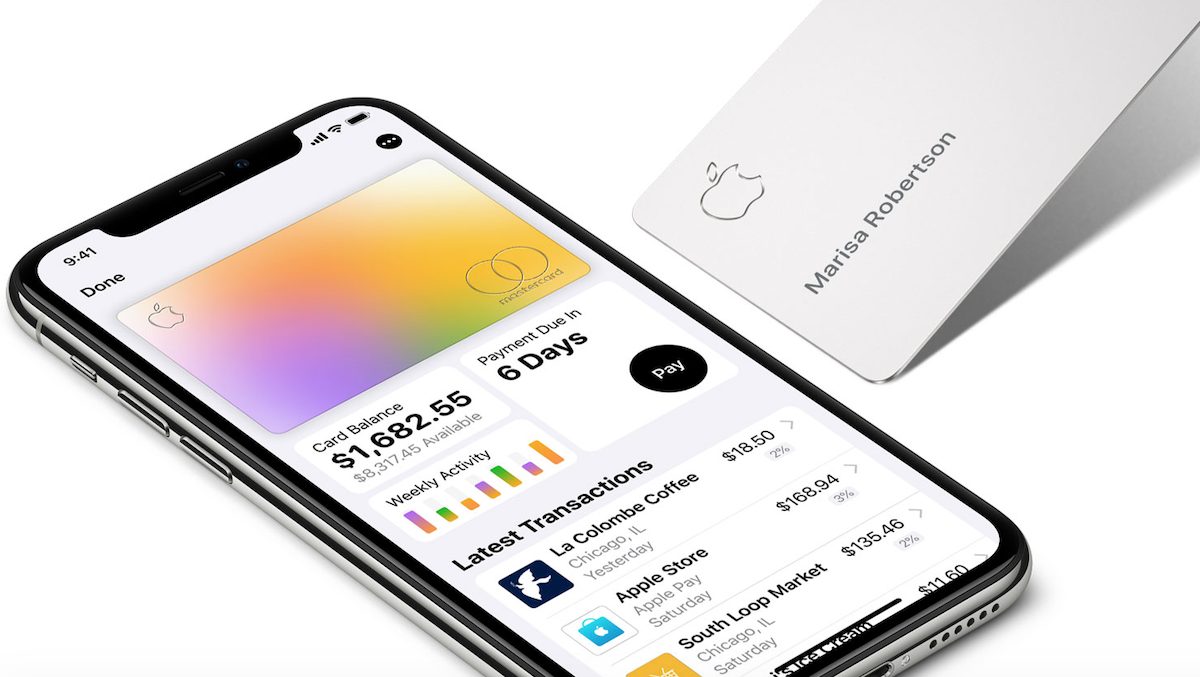

Apple’s credit card launched three years ago in August 2019. While its features and functionalities have grown considerably since then, it remains exclusive to users in the United States. Apple Card owners can enjoy numerous perks such as getting up to 3 percent Daily Cash when they use Apple Card online, in-store, and in apps. Apple also routinely offers discounts and promotions for external stores and services.

Furthermore, the Apple Card Family feature, which was announced in 2021, allows spouses to share accounts and enables families with members over thirteen years old to share a single Apple Card. The feature enables spouses and partners to share and merge their credit lines and have equal rights on the account which will allow them to “build credit equally.”