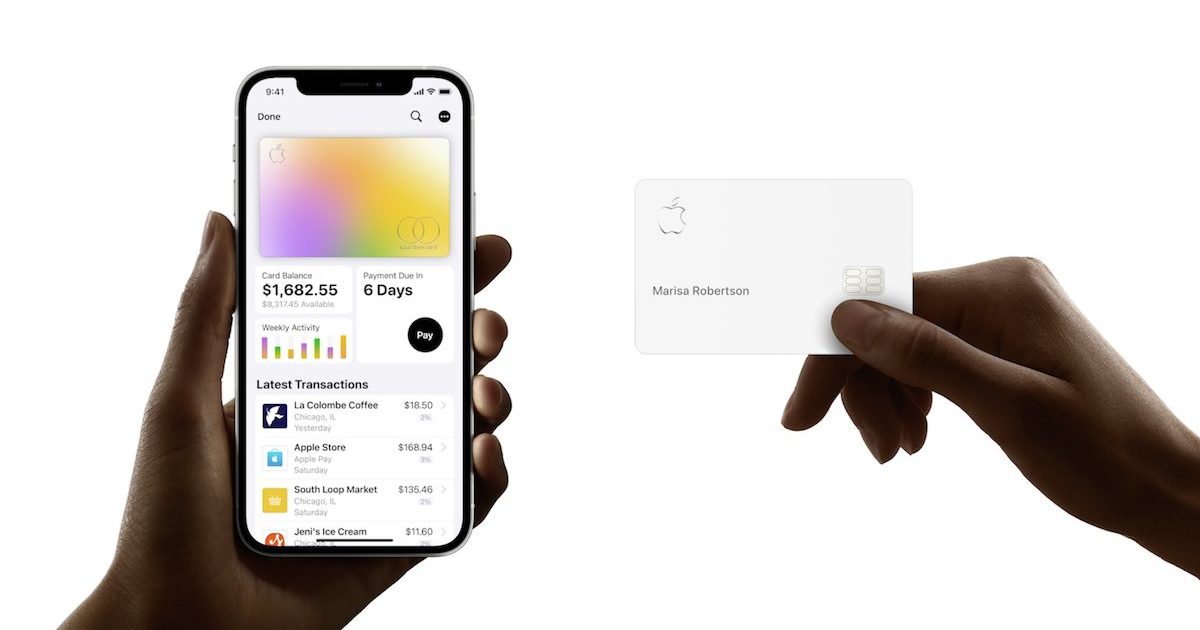

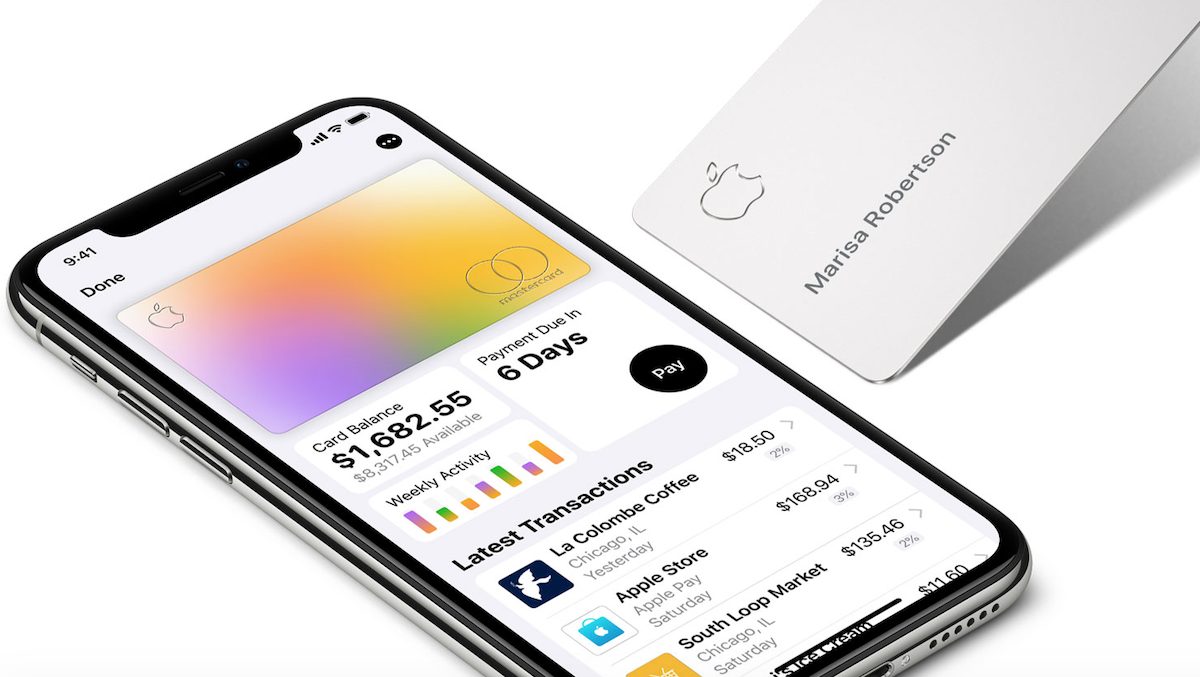

Apple’s services have been under investigation numerous times. The tech giant’s financial offerings which include the Apple Card, Apple Pay, its Savings account, and more, are the latest services to be under scrutiny. A UK regulator has launched a formal probe into Apple’s financial services.

Apple’s financial services, including Apple Card, under scrutiny

In recent years, Apple has expanded its financial services significantly. With a credit card, a buy-now-pay-later service called Apple Pay Later and a new Saving account, regulators have raised concerns. The latest development comes from an antitrust authority, The Financial Conduct Authority (FCA), in the United Kingdom. As reported by The Financial Times:

The Financial Conduct Authority (FCA) is launching an inquiry this week into strikes by Apple, Amazon, Google and Facebook’s father or mother Meta into retail monetary companies. It is asking the Big Tech firms, their companions and potential rivals for his or her views on Silicon Valley’s enlargement into funds, deposits, credit score and insurance coverage.

The main concern the authority has with Big Tech offering financial services is that they may “lock consumers in,” with their tightly-knit ecosystems.

While acknowledging that customers might profit within the quick time period, the FCA means that Big Tech firms may have the ability to “exploit their ecosystems” and enormous information shops to “lock consumers in”, as in different markets the place they already face regulatory scrutiny, resembling cell app shops.

Since financial services offered by tech companies may seem attractive for users due to deals and benefits, the FCA says that it can pose a threat to competition in the market.

“Based on evidence in Big Tech firms’ core markets and their expanding ecosystems, there are competition risks arising from them rapidly gaining market share, markets ‘tipping’ in their favour and potential exploitation of market power,” the FCA wrote in its 61-page evaluation. “This could be harmful to competition and consumer outcomes.”

In related news, Apple Card partner Goldman Sachs is also under investigation by the Consumer Financial Protection Bureau (CFPB). The regulator is looking into Goldman Sach’s ”account management practices, including with respect to the application of refunds, crediting of nonconforming payments, billing error resolution, advertisements, and reporting to credit bureaus,” after numerous customer complaints. Specifically, complaints filed by Apple Card holders.