Issuer Goldman Sachs and Apple Card rank the “Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee” in the United States for the third consecutive year by J.D. Power.

Founded in 1968, J.D. Power is an American software, data analytics, and consumer intelligence company. It has pioneered the understanding of consumer behavior through the use of data, artificial intelligence, and algorithmic modeling capabilities.

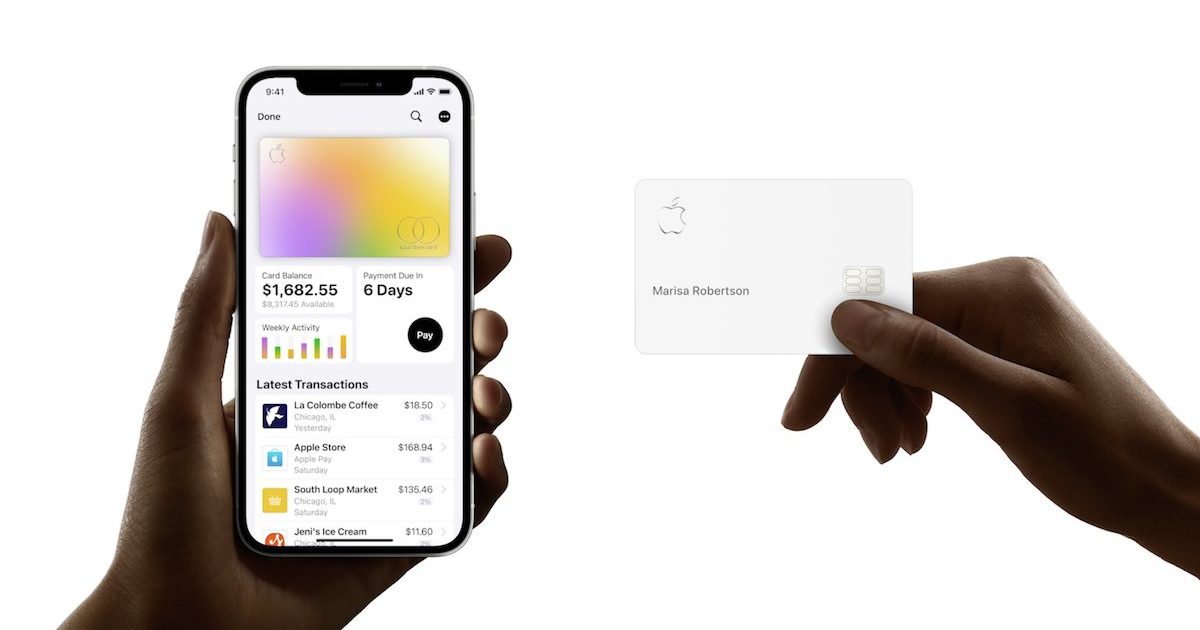

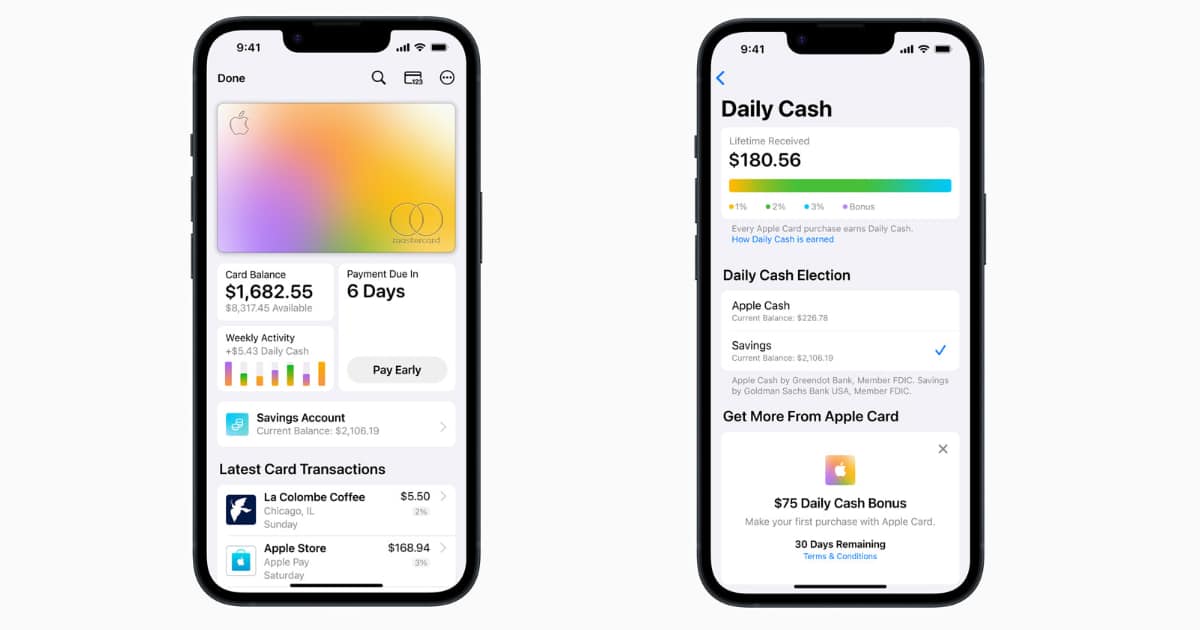

In 2019, the Cupertino tech giant launched the Apple Card for all of its U.S. customers in partnership with Goldman Sachs. Integrated with the iOS Wallet app, the digital credit card offers contactless transactions, installment plans, up to 3% Daily Cash Back on purchases, and more with no interest and hidden fees. Furthermore, cardholders can easily manage their accounts and track their spending and payments in the Wallet app.

In April this year, the tech company introduced Apple Card’s high-yield Savings account by Goldman Sachs with a high-yield APY of 4.15 percent. The Savings account allows cardholders to grow their Daily Cash rewards with a Savings account from Goldman Sachs and more.

In the first four days of launch, the Apple Card Savings account drew nearly $1 billion in deposits and in a few months, it had over $10 billion in deposits.

Will Apple Card rank no.1 even after the departure of financial partner Goldman Sachs?

Expressing gratitude for Apple Cark rank for the third consecutive year, Apple’s vice president of Apple Pay and Apple Wallet Jennifer Bailey recognized Goldman Sachs’ valuable partnership in offering users a way to enjoy a “healthier financial life” and said they would continue to expand the service to offer newer ways to manage finances.

“Since the start, we’ve been committed to delivering tools and services that help users live healthier financial lives, and it’s been rewarding to see customers using and finding value in the benefits of Apple Card. We are honored that Apple Card has been recognized as a leader in customer satisfaction.

“In partnership with Goldman Sachs, we are continuously working to expand the value users receive from Apple Card, most recently with the launch of Savings, and we look forward to continuing to develop tools and services that put our users and their financial health first.”

However, it is reported that Goldman Sachs’ is leaving the partnership with Apple as the Wall Street firm prepares to shut down all of its consumer business. Allegedly, Goldman Sachs suffered losses of over $1 billion as a result of the Apple Card partnership and planned to stop further extension of its credit card program and become a full-service bank.

Reportedly, the Wall Street firm is negotiating a takeover with American Express. It is unclear if Apple is on board with the plans because its approval is required to finalize the deal.

Read More: