Expanding its financial services, the Cupertino tech giant launched the Apple Card Savings account last month and the inclusion of the new high-yield saving account has proven to be very beneficial for the company.

Forbes reports that in the first four days of launch, the Apple Card Savings account drew nearly $1 billion in deposits. Two people familiar with the matter said that Apple Card users deposited nearly $400 million on the day of the launch and $990 million were deposited in the first four days.

The 4.15% interest and “ubiquity” of iPhones likely drove Apple Card Savings account openings

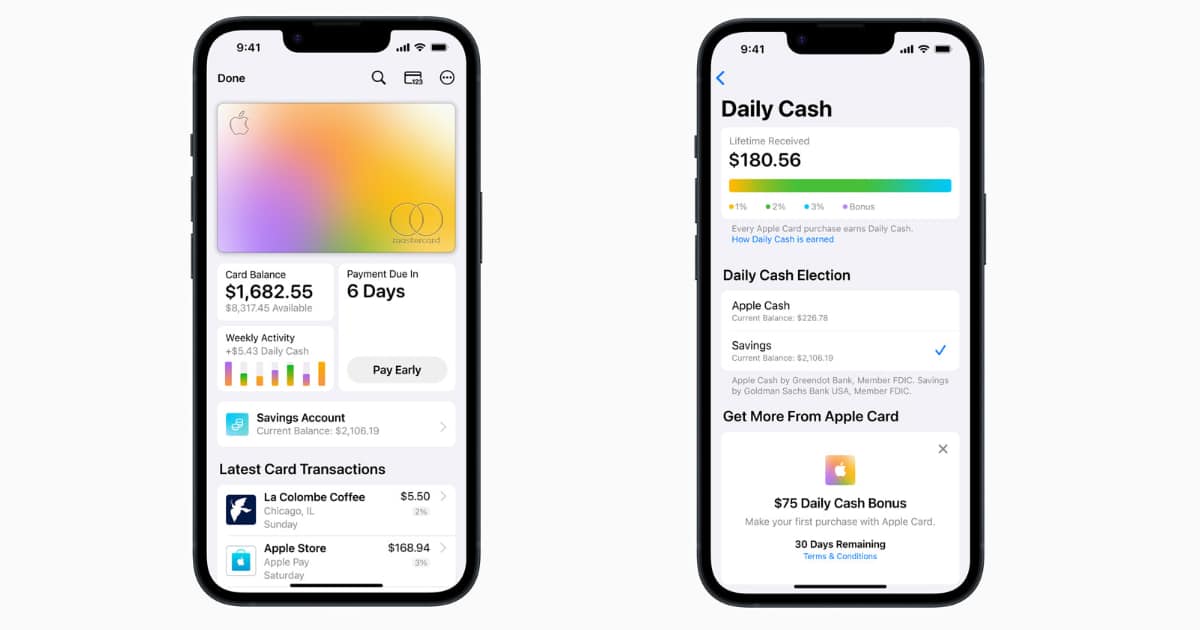

In partnership with Goldman Sachs, the tech giant introduced the Savings account for Apple Card with a high yield interest of 4.15%, more than 10 times the national average. Users’ Daily Cash rewards earned on purchases through Apple Card are automatically deposited in the Savings account with no fees, minimum deposits, and no minimum balance requirements.

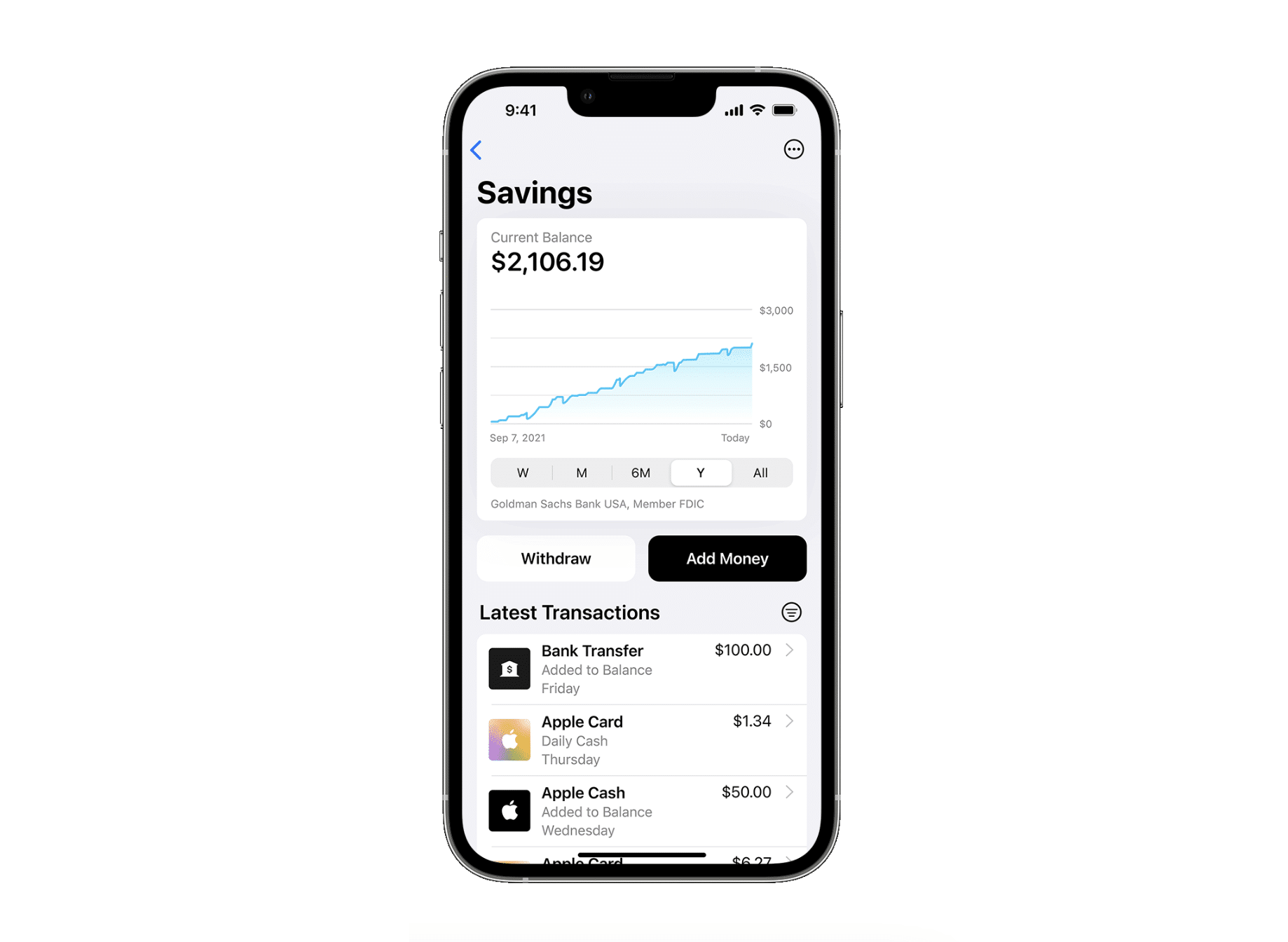

The Savings accounts can be managed easily and directly through Apple Card in the Wallet app to view their balance and interest earned. Users can also withdraw funds at any time by transferring the amount to their linked bank account or Apple Cash card with no fee.

Thus, the publication believes that the “account’s eye-catching 4.15% annual return, plus the ubiquity of iPhones” drove Apple Card Savings account openings. In the first week, approximately 240,000 accounts were opened because traditional most banks in the United States currently do not offer such a high-interest rate on savings accounts.

- Barclays offers a 4% APR

- Owned by Goldman Sachs, Marcus Bank offers a 3.90% APR

- Citi Bank offers a 3.85% APR

- American Express offers a 3.75% APR

- Discover offers a 3.75% APR

- Capital One offers a 3.50% APR

Richard Crone, CEO and founder of payments firm Crone Consulting said;

“Banks have quickly responded to the Fed’s interest rate hikes with higher mortgage and car loan rates, but savers have seen little to no increase in traditional bank deposits or savings accounts,” says. There’s an outflow to CDs, money market funds, and fintechs like Apple.”

Although there are digital banks that offer high-yield interest rates from 2% to 4.25% like Bask Bank, Current, Varo, and others, Apple’s seamless user experience and iPhone integration have given its Apple Card Savings account an “edge” over its competitors.

At the time of launch, Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet said that the new Apple Card Savings account will allow users to get more value out of their credit card, and apparently, consumers agree.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day. Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”