Nearly after four years, Goldman Sachs is preparing to end its partnership with Apple.

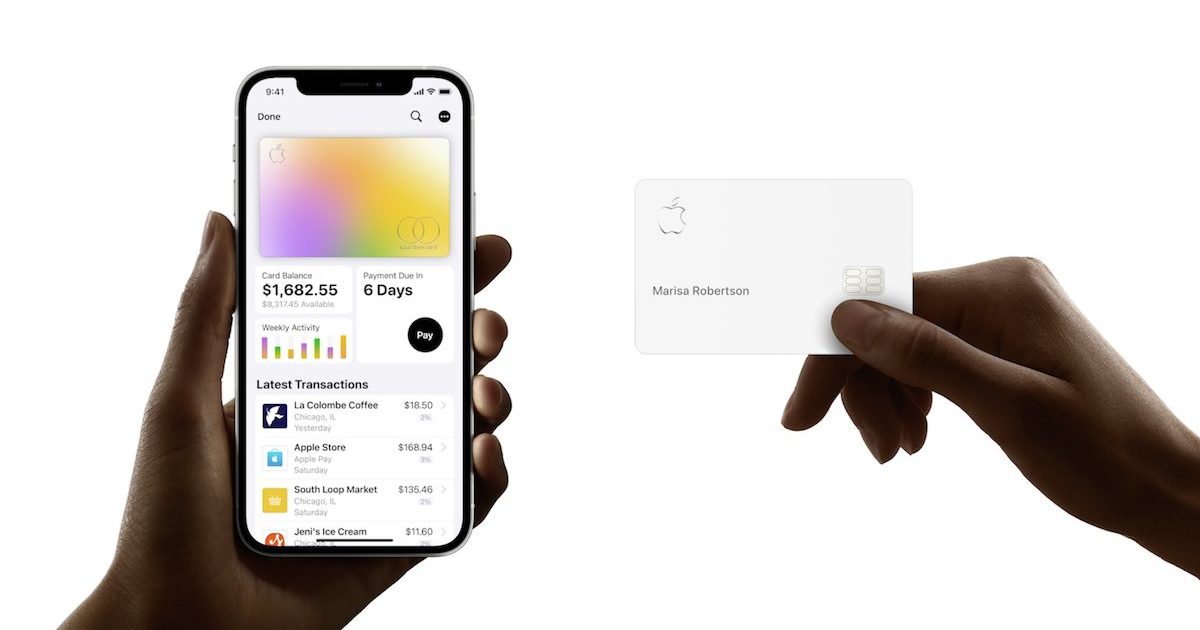

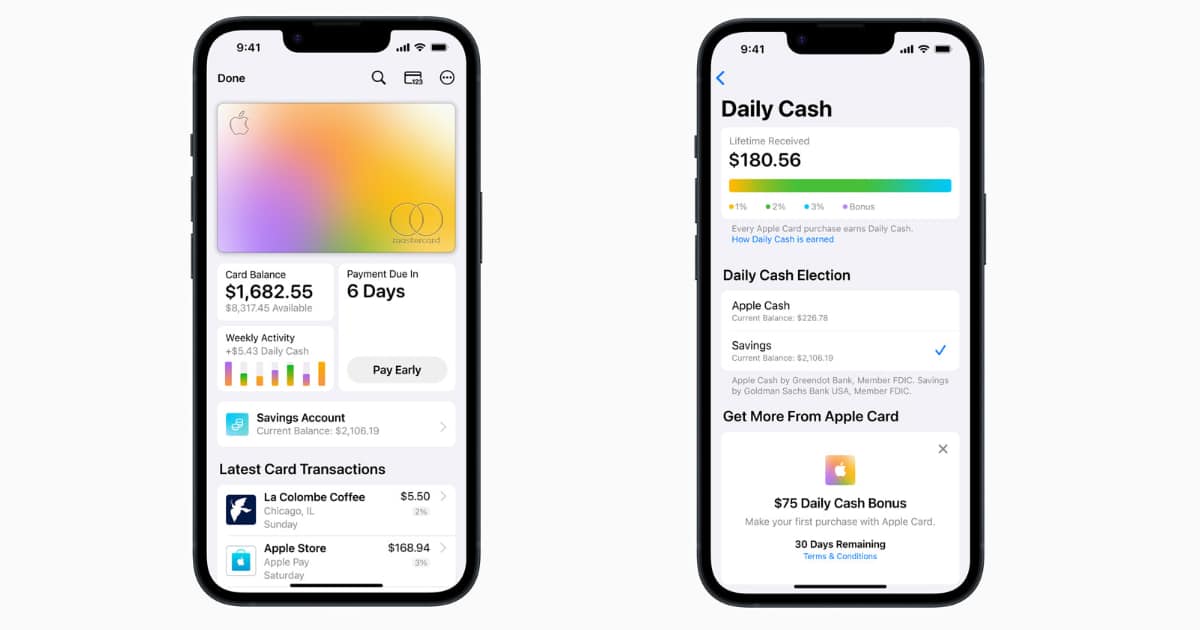

In 2019, the Cupertino tech giant launched its own credit card, Apple Card in partnership with Goldman Sachs, a global investment banking firm. Recently, the duo has introduced two more services in the United States: Apple Pay Later and Apple Card high-yield Savings account.

However, in its efforts to pull out of the consumer business, the Wall Street firm is in talks with American Express to take over its partnership.

Goldman Sachs in talks with American Express to transfer Apple’s financial ventures

Last year, Goldman Sachs announced that it planned to end its consumer-lending business but continued to launch new financial products with Apple.

Now, The Wall Street Journal reports that Goldman has lost nearly $3 billion on the consumer lending push since 2020 and its Chief Executive David Solomon has faced a lot of criticism internally for venturing into costly “consumer foray”.

Earlier this year, it was reported that Goldman Sachs suffered losses of over $1 billion as a result of its Apple Card partnership.

Goldman Sachs is stopping plans to further extend its credit card program. One of Goldman’s earliest ventures into consumer banking was the Apple Card. A co-branded card with General Motors is the only other consumer credit card offered by the bank. The bank had been negotiating with T-Mobile to introduce a co-branded credit card, but those talks have recently come to an end.

Although at the time, the investment firm displayed strong confidence in its partnership with the Cupertino tech giant and anticipated that it would be successful in the long term.

However, it can be assumed that financial pressures have forced Goldman Sachs to “seal the fate” of its plans to become a full-service bank by ending its partnership with Apple and transferring the tech giant business to American Express.

Now it is in talks to offload those businesses and its credit-card partnership to Amex, according to people familiar with the discussions. Goldman has also discussed transferring its card partnership with General Motors to Amex or another issuer, some of the people said.

The tech company is aware of the talks, which have been ongoing for months, the people said.

Having said that it is not certain that Goldman’s deal with American Express would finalize because transfer of the partnership is dependent on the tech giant’s approval.

After ending its partnership with Apple and selling GreenSky, Goldman’s consumer business will only include the Marcus savings account, its original product.