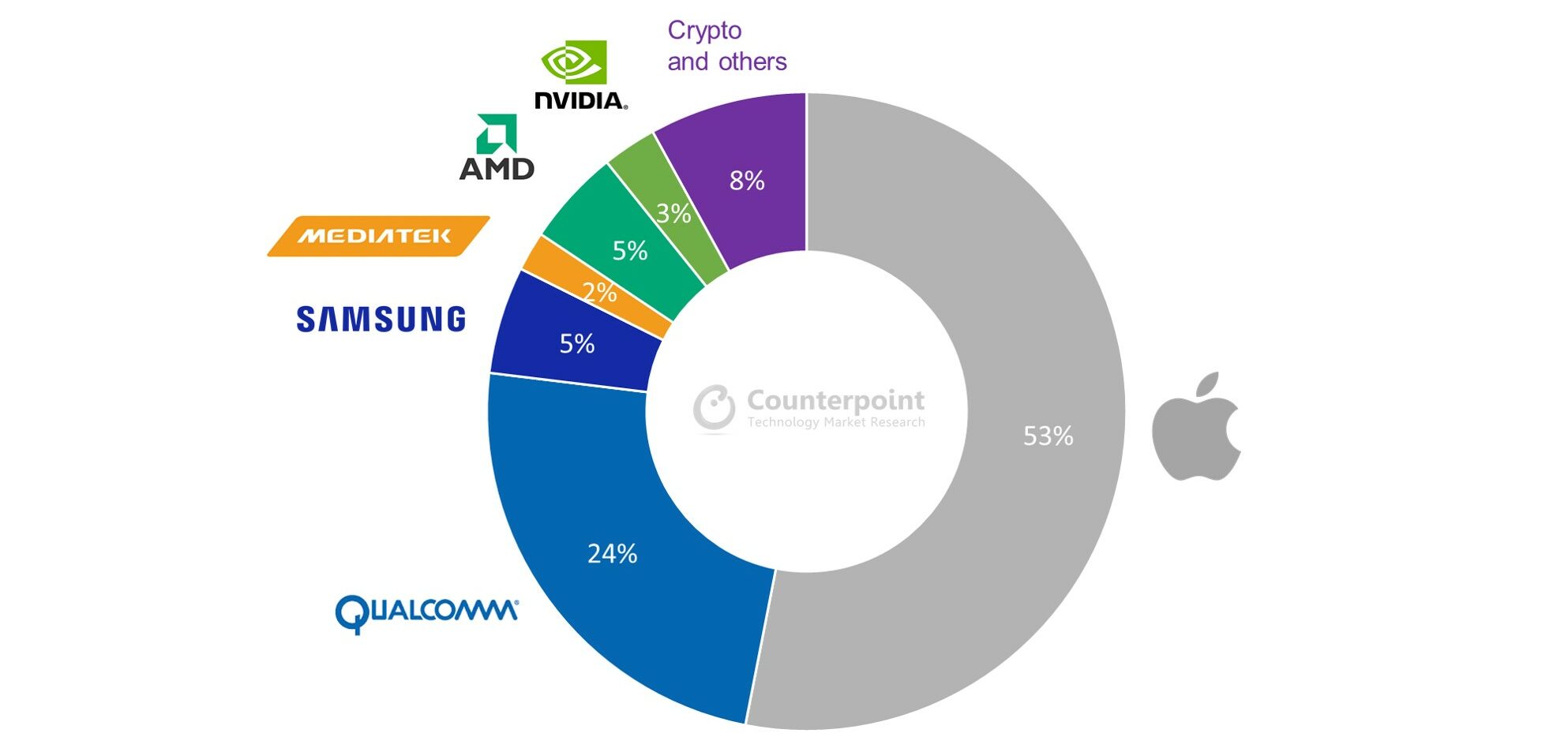

Apple’s 5nm chip shipments will amount to more than 50% of the overall market share in 2021, compared to other companies like Qualcomm, Samsung, AMD, and Nvidia. Intel is noticeably missing from this list because they are still stuck on 10nm.

TSMC is the biggest supplier of 5nm chip production, followed by Samsung. TSMC is popularly known for manufacturing Apple’s A-series chips for iPhone and iPad, as well as the recently released Apple Silicon M1 chip for MacBook Air, MacBook Pro, and Mac mini. Apple’s demand for chips is expected to grow as it is expected to move more of its Macs to 5nm Apple Silicon chips throughout 2021.

Apple leads in 5nm market share, followed by Qualcomm in second place, and Samsung in a distant third position

Both TSMC and Samsung, major players in the foundry industry, are expected to see double-digit growth in 2021. Counterpoint Research expects TSMC to post 13%-16% year-over-year sales growth in 2021, while Samsung is expected to post 20% year-over-year growth thanks to customers like Qualcomm and Nvidia.

TSMC was ahead of Samsung with mass production of 5nm chips, from Q1 2020. Samsung joined the 5nm party around Q3-Q4 of 2020. The demand for 5nm chip production is expected to grow throughout 2021, as more companies release new products that utilized the node. Both TSMC and Samsung are also using EUV (extreme ultraviolet lithography), which allows them to be head of the rest of the industry when it comes to packaging more transistors per chip. Counterpoint Research reports:

5nm is considered a fully adopted EUV node for both foundries as Intel’s equivalent 7nm announced another delay in production last year. Based on our estimates, the total wafer shipment volume of 5nm will account for 5% of 12-inch wafers in the global foundry industry in 2021, up from less than 1% in 2020. Apple is the top customer (with all orders to TSMC) in 5nm this year (see Exhibit 1), including both for iPhones (A14/A15) and the newly released Apple Silicon Qualcomm will be the second-largest 5nm customer as the iPhone 13 may adopt its X60 modem. TSMC is expected to book $10-billion revenue from 5nm in 2021. Samsung Foundry will also gain good traction from 5nm order wins, including its in-house (Exynos) SoC and Qualcomm.

7nm node is still the most popular at the moment as it is used in a large variety of chips still being sold in the market. Smartphones are expected to consume only 35% of the wafers used for 7nm chips, while AMD and Nvidia will take a majority of the share with 27% and 21% respectively. AMD has released new processors and graphics cards, as well as provides components for both PlayStation 5 and the new Xbox, which increases its demand for 7nm node, compared to Nvidia, which is using the manufacturing process for its graphics cards, and other areas.

Despite the constant growth, the industry has not peaked yet. There is still room for further growth as Counterpoint Research concludes that the market for the foundry industry is expected to cross $100 billion in size during 2022-2023.

Read more:

- TSMC posts record revenues hinting at strong iPhone 12 demand

- Hedge Fund asks Intel to take action in the face of threats from Apple, TSMC, and others

- 3nm chips order has been secured by Apple for 2022 with TSMC

- TSMC will provide self-driving chips for Tesla-like Apple Car – Report

- TSMC to start 3nm mass production in 2H 2022, which could be used for Apple Silicon