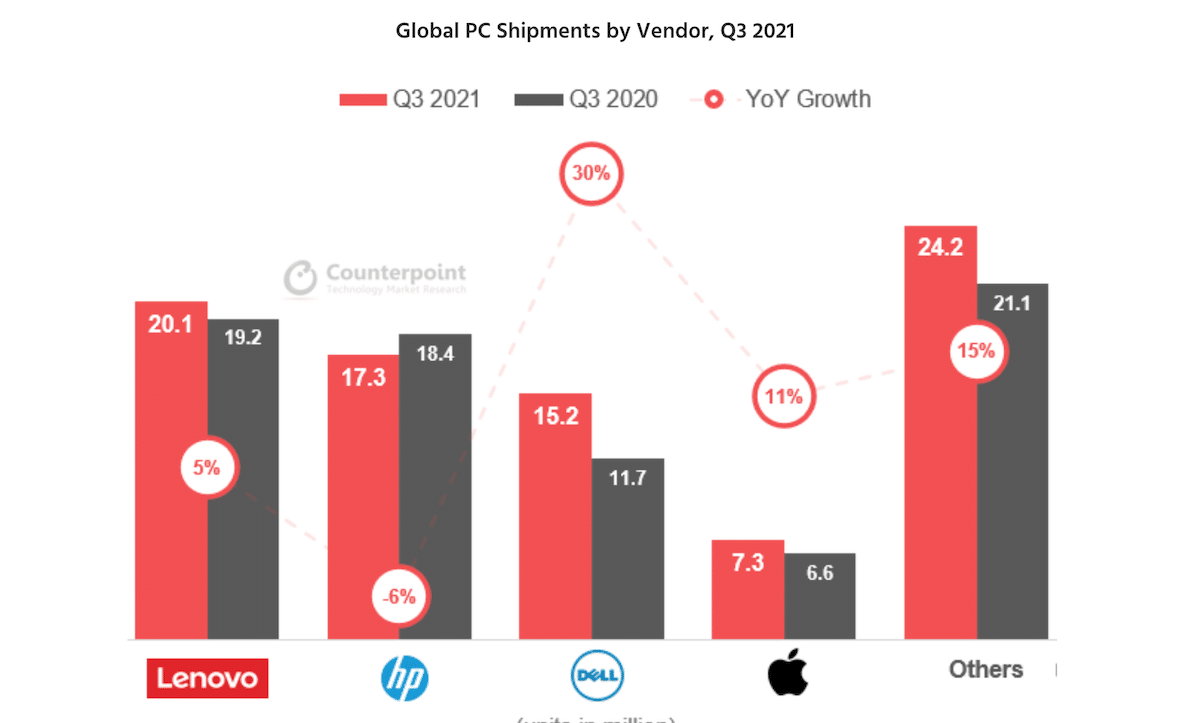

Counterpoint’s new study on global PC shipments reveals that Apple’s PC shipments grew by 11% Y-o-Y due to M1 Macs in the third quarter of 2021. It is noted that in spite of the prevailing components shortage, the PC market segment saw growth for the sixth consecutive year in Q3 2021, 9.4% Y-o-Y growth with 84.2 million units sold, worldwide.

Strategy Analytics also predicts that Apple will lead the Arm-based notebook PC processor market in 2021 because of the M1 chip. The Cupertino tech company will likely capture an 8% share of the growing market segment which is estimated to be worth $949 million in 2021.

For the same quarter last year, Apple’s shipments grew from 6.6 million units in 2020 to 7.3 million units in 2021 because of M1 Mac

Although far behind Lenovo, HP, and DELL, Apple is gradually capturing a bigger share of the PC market because of M1 Mac models. The report states, “Apple’s shipments grew 11% YoY in Q3 2021 riding on the replacement demand for the M1 Mac.”

In 2020, Apple began the transition of the Mac lineup from Intel processors to Apple Silicon. The company launched 13-inch M1 MacBook Air, 13-inch MacBook Pro, M1 Mac mini, and in 2021, it launch 24-inch M1 iMac. The faster performance and incredible battery life delivered by the M1 chip, made the new Mac models popular.

Apple recently announced new14-inch and 16-inch MacBook Pro models powered by next-generation M1 Pro and M1 Max chips. The new Pro notebooks are deemed fit for professionals because of their much much powerful CPU and GPU processor. And luckily for Apple, ahead of the new MacBook Pro models launch, the report states that the demand for commercial PC is increasing. “PC demand remained solid during the quarter. Commercial PC demand is gradually heating up while consumer PC momentum is decelerating.”

Financial analysts also forecast that the new MacBook Pro models are going to boost Apple’s sales in the coming December quarter. Furthermore, it is also predicted that the ongoing supply constraints are going to last till the middle of 2022 which might have an impact on the supply and demand chain.

In Q3 2021, the global PC supply chain remained constrained due to component shortages related to power management IC, radio frequency, audio codec and others. We believe there is no solution to this demand-supply mismatch till mid-2022. ODMs are still pulling in chips inventory to tackle any downside risks. Besides, unstable global logistics and manufacturing site shutdowns in Southeast Asia and China add more uncertainties to PC supplies.