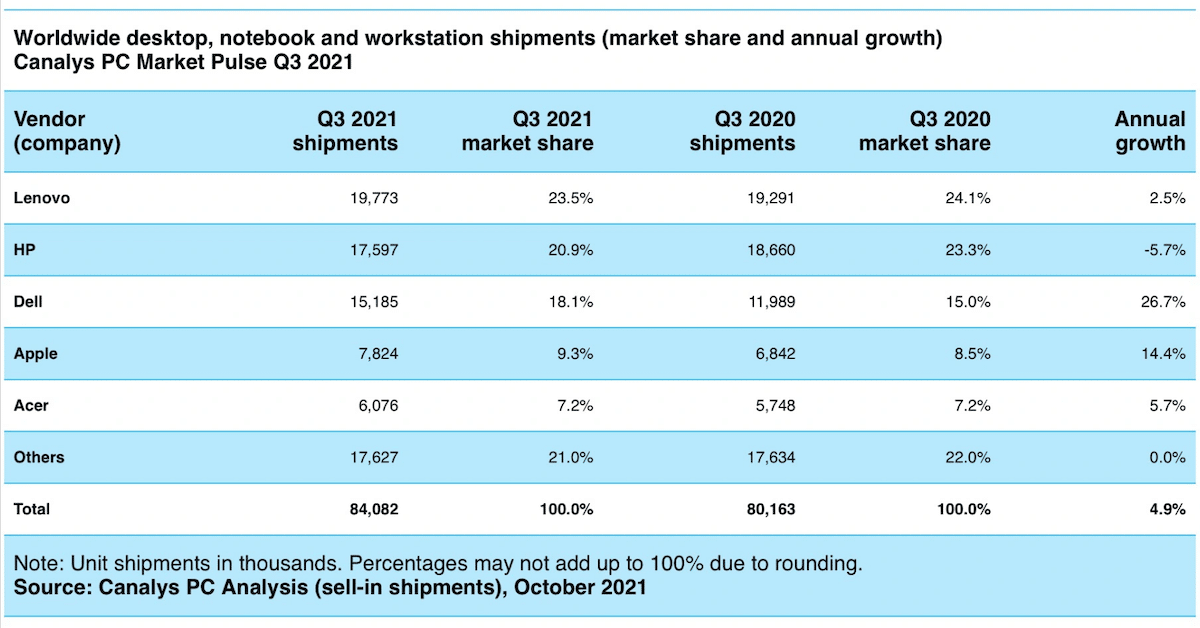

Apple’s Mac shipments grew by 14.4% Y-o-Y in Q3, 2021. Canalys’ new PC market research reveals that Apple captured a 9.3% PC market share in the third quarter of 2021.

This is good news for the Cupertino tech giant which has been upgrading its entire Mac lineup to Apple Silicon since 2020. The tech giant launch first-generation 13-inch M1 MacBook Air, M1 MacBook Pro, and Mac mini models in 2020 and a 24-inch iMac in 2021. Two new 14-inch and 16-inch MacBook Pro models are expected to launch in October or later this year. M1 chip has delivered exceptional performance and battery life which are attractive features for consumers.

With an increase in Mac shipments, gain Apple a 9.3% global PC market share in Q3, 2021

The study shows that the global PC market saw a 5% growth in Q3, 2021 with 84.1 million which is a major drop from double-digit growth in the previous 5 months. Although the volume of shipments remained high because of strong Q3 2020, PC business suffered due to supply and chain challenges. Therefore with a higher number of shipments, Lenovo and HP saw meager growth. Dell led the PC market in Q3, 2021 with 26.7% Y-o-Y growth and Apple secured the second spot with 14.4% growth. Lenovo saw 2.5% growth and HP saw -5.7% growth in the third quarter of 2021.

Ishan Dutt, Senior Analyst at Canalys elaborates that supply chain constraints, global chip shortage, and COVID-19 restrictions in Asia (the world’s manufacturing hub) have an adverse impact on the growth of the PC market. Dutt estimates that the shortfall will persist till 2022.

“Disruption to the global supply chain and logistics network remains the key inhibitor of higher growth in the PC market. More than a year on from the onset of the pandemic, manufacturing continues to be hindered by lockdowns and other COVID-19 related restrictions, particularly in Asia. This has been compounded by a massive slowdown in global transportation with freight prices and delay times skyrocketing as a number of industries compete to meet unfulfilled demand. The shortfall in supply of PCs is expected to last well into 2022, with the holiday season of this year set to see a significant portion of orders not met. Vendors able to manage this period of operational upheaval by diversifying production and distribution and having better visibility of orders to prioritize device allocation will be equipped to ride out the storm.”