Financial Times reports that Apple is on the path to breaking iPhone’s average selling price (ASP) in the coming months, twice as more and more consumers opt for the new iPhone 14 Pro models.

This year’s iPhone 14 series is different from its predecessor. In addition to 6.1-inch iPhone 14, Apple has introduced an all-new 6.7-inch base model. The 5.4-inch iPhone mini revealed that consumers have an appetite for larger displays and longer battery life.

Furthermore, the new Pro lineup offers a lot more than the new base models. Powered by an advanced A16 Bionic chip, iPhone 14 Pro models feature a 48MP camera, Always-On display, Dynamic Island, and more.

More importantly, Apple is delivering advanced innovative technology at the same price as the 2021 iPhone 13 series, a very beneficial strategic move.

Apple’s average iPhone selling price will hit $944 by December, thanks to iPhone 14 Pro

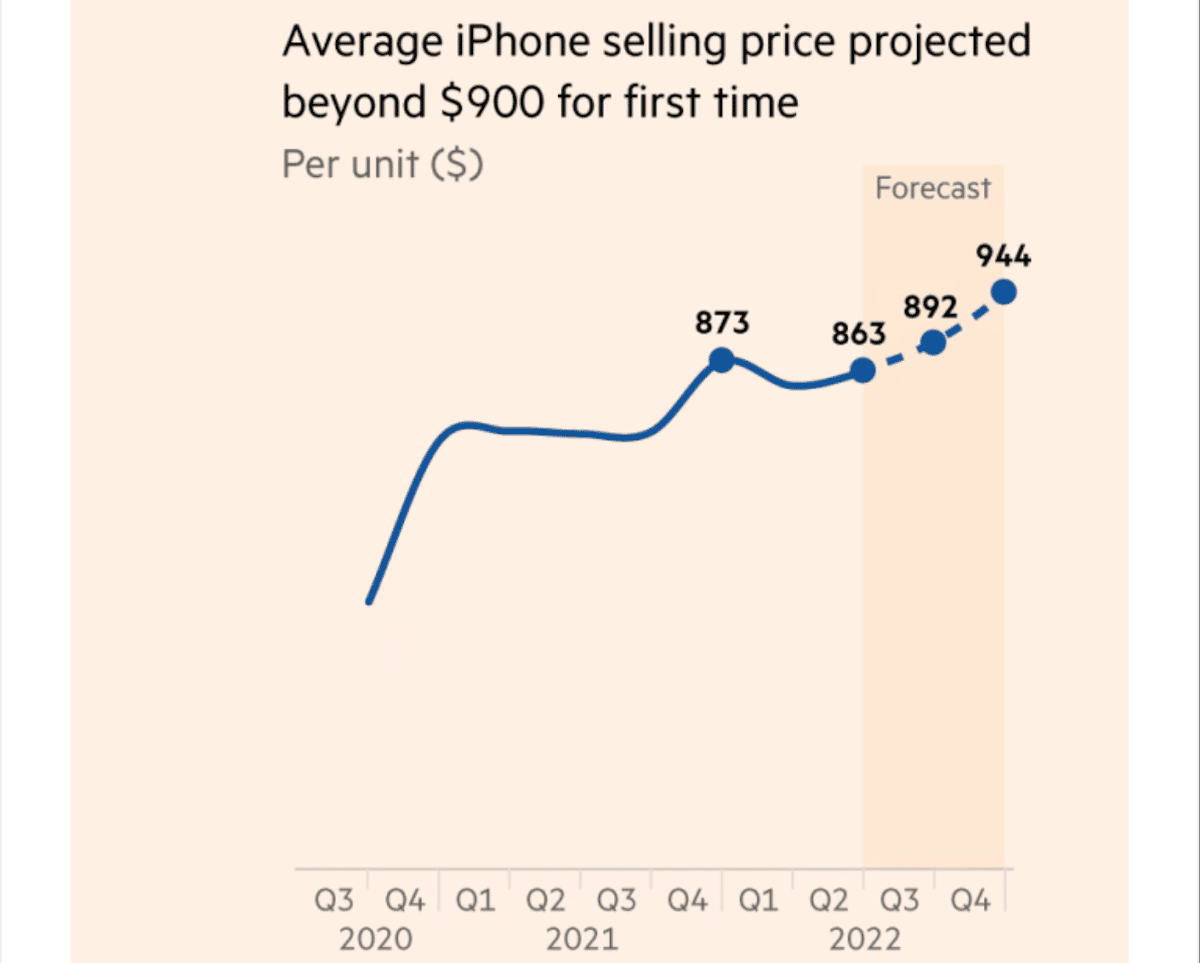

Apple’s average iPhone selling price is $873 which was achieved in Q4, 2021. Based on the iPhone 14’s current upward trajectory, it is estimated that by the September quarter it will hit $892 and will jump to $944 in the December quarter.

Demand for the new iPhone 14 unveiled earlier this month is already robust enough to project that the global “average selling price” — or ASP — will rise to a record $892 in the September quarter and $944 in the December quarter, according to Counterpoint Research, a data provider, which bases its projections on consumer demand, market intelligence, and talks with suppliers.

The report credits the upward trajectory in the iPhone’s ASP to the popularity of the iPhone 14 Pro and Pro Max models. More than 56% of consumers surveyed by Evercore ISI said that they planned to purchase a Pro model. In 2021, 41% of consumers want to buy a Pro model.

“We are increasing our iPhone revenue estimates for the next four quarters on the back of stronger than expected ASPs,” Evercore analyst Amit Daryanani told clients.

It anticipated that ASPs in the next year would be around $940, about 10 per cent higher than in the iPhone 13 cycle.

Apple dominates the premium smartphone market with a 57% share of the above $400 segment and a 78% share of the over $1000 ultra-premium segment.

“Other Android manufacturers — Vivo, Oppo and Honor — all have entered the premium segment, but premium brand status cannot be built overnight,” said Counterpoint analyst Archie Zhang.

After transitioning from volume to revenues in 2018, analysts believe that the tech giant’s next step would be to “transition from ASPs towards “lifetime user value” — a strategy of increasing revenues from its more than 1bn iPhone users with an expanding array of services.”