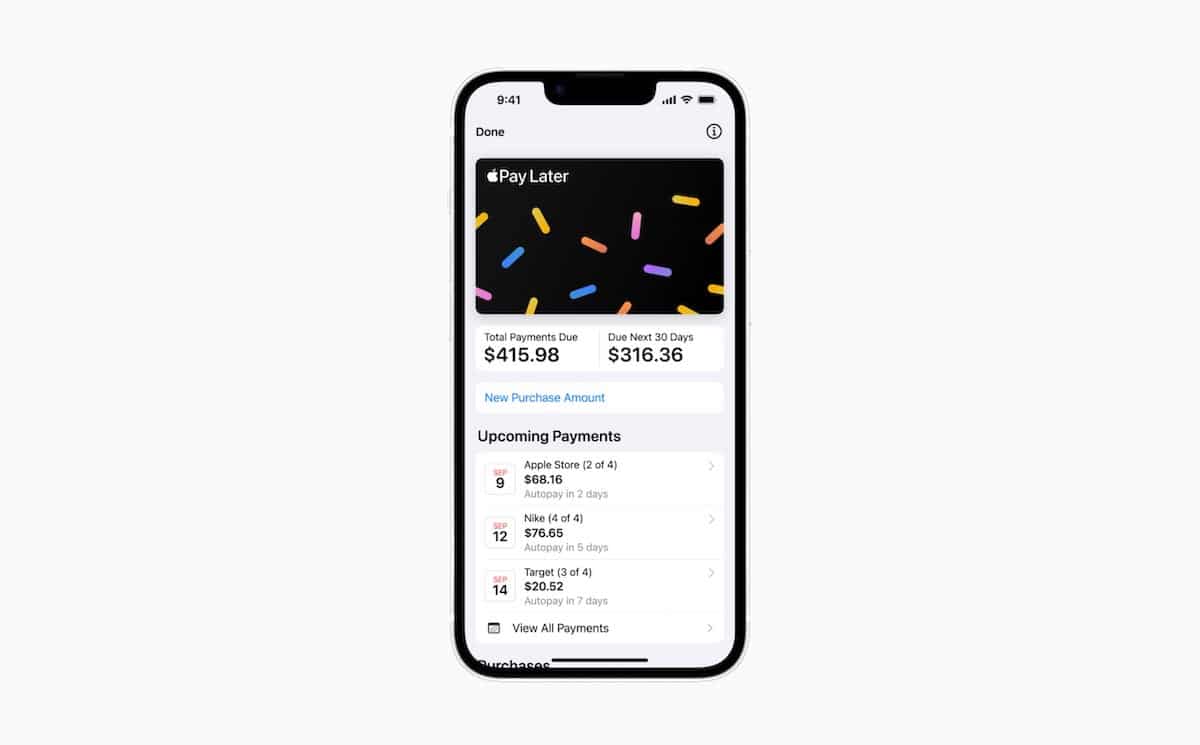

Cupertino tech giant has launched a new payment service, Apple Pay Later in the United States. Now, iOS and iPadOS users can apply for loans of $50 to $1,000 directly from the Apple Wallet for purchases via Apple Pay and pay the amount in four equal installments spreads over six weeks.

More importantly, the service allows users to pay for purchases over time with no interest and no fees and track and manage loans within the Wallet app. However, only select users will get early access to the pre-release version of the service via the Wallet app and through their Apple ID email.

How is how to apply for Apple Pay Later loans up to $1000

Apple Pay Later is built into the Wallet app on iOS and iPadOS, so it is very easy for users to get started. Here is how to apply for a loan with no impact to your credit.

- Open the Wallet app

- Enter the amount for the Apple Pay Later loan of $50 to $1,000.

- Agree to the service’s terms. At this point, a soft credit pull is done to ensure that the user’s finances are in a good position to take a loan.

- Link your debit card from Wallet as your loan repayment method. Credit cards are not accepted.

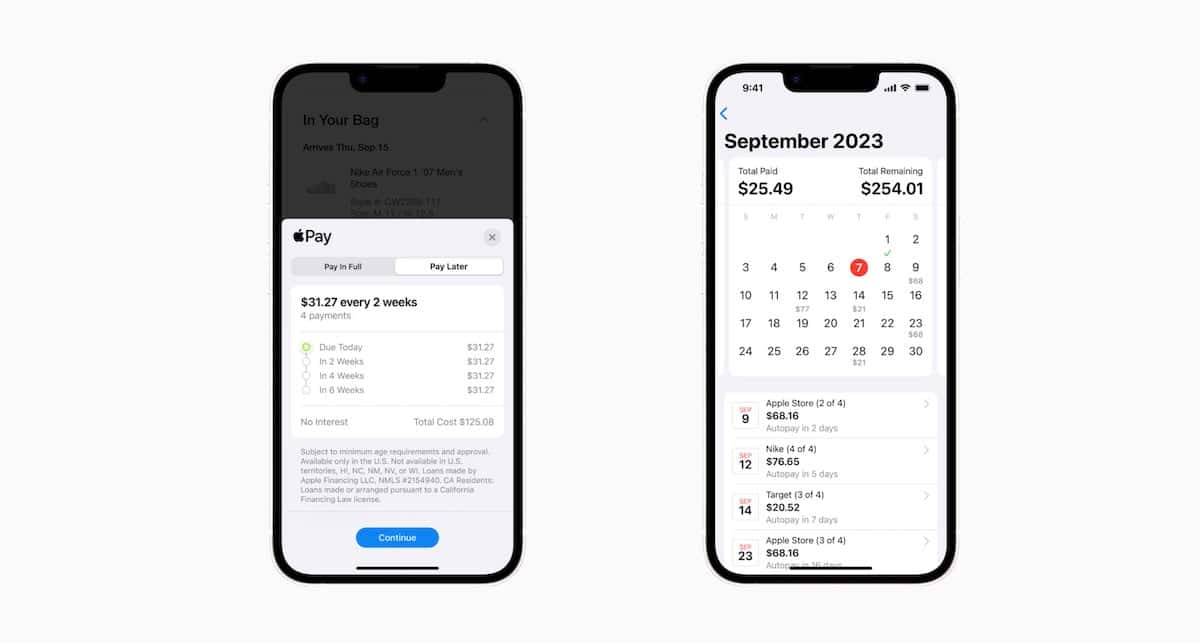

- Upon approval, a new Pay Later tab appears when Apple Pay is used at checkout online and in apps to make a purchase. *All the purchases are authenticated using Touch ID, Face ID, or passcode.

- Users will receive notifications and emails when a payment is due.

Once Apple Pay Later is set up, users can directly apply for loans in the checkout flow when making a purchase via Apple Pay in the Wallet app. Keeping users’ privacy and security in mind, the service does not share users’ transaction and loan histories with third-party digital advertisers and marketers.

Apple Pay Later requirements

- The service is available on iPhone and iPad and requires iOS 16.4 or later and iPadOS 16.4 or later.

- It is only available in the United States.

Apple’s vice president of Apple Pay and Apple Wallet said that Apple Pay Later was designed to offer customers a flexible payment service to manage their finances without worrying about paying interest and over-due fees.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

The new payment service will be available to all eligible users in the United States in the coming months and starting this fall, Apple Financing will report Apple Pay Later loans to U.S. credit bureaus so they are reflected in users’ financial profiles and promote responsible lending for the lender and the borrower.

Read More:

- Download iOS 16.4 and iPadOS 16.4 firmware IPSW files

- iOS 16.4 and tvOS 16.4 add new “Dim Flashing Lights” accessibility feature

- New iOS 16.4, macOS 13.3 and other updates patch over 30 security exploits

- Apple Podcasts app updated with new features in iOS 16.4, iPadOS 6.4 and macOS 13.3

- iOS 16.4 brings new order tracking widget for Apple Pay purchases

- iOS 16.4 and macOS 13.3 add new action options to the Shortcuts app

- Apple adds support for PlayStation 5 DualSense Edge controller in iOS 16.4