To make a deeper mark in the financial services industry, Bloomberg claims that Apple will handle the lending itself for new Apple Pay Later transactions and it will not rely on its financial partners for processing services like credit checks, lending, and others.

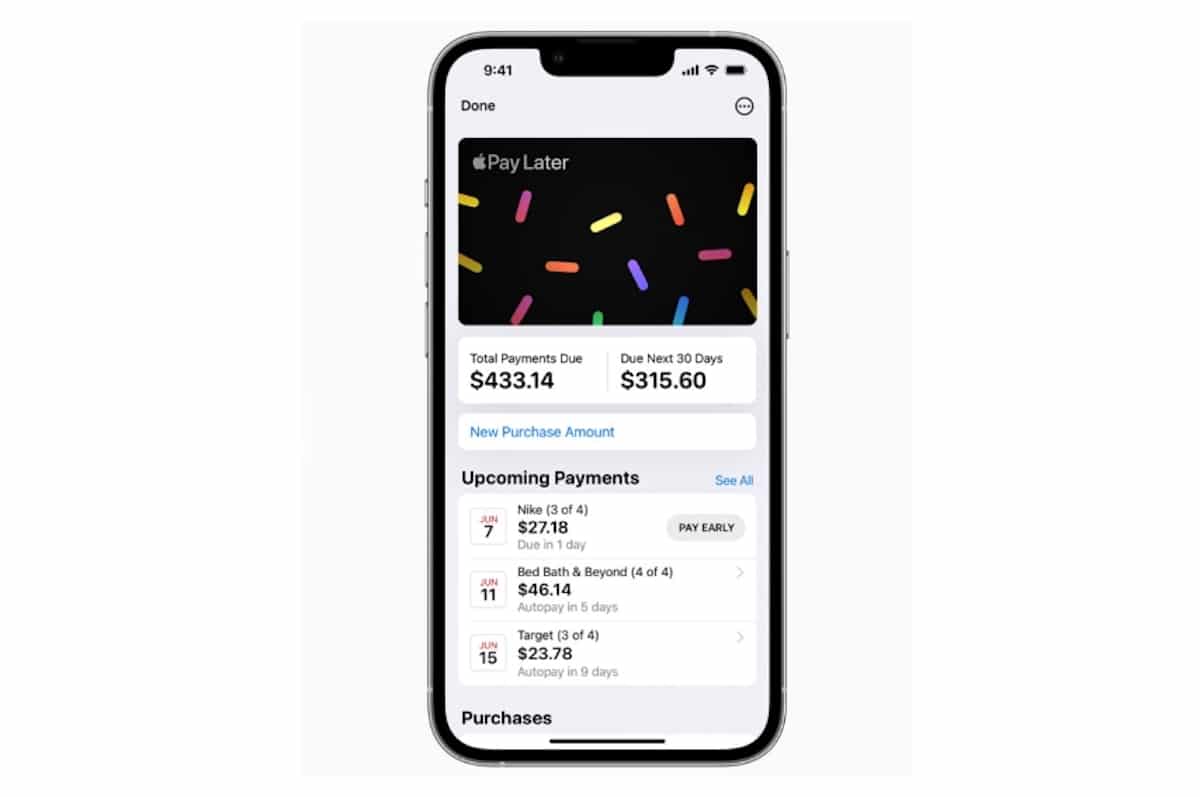

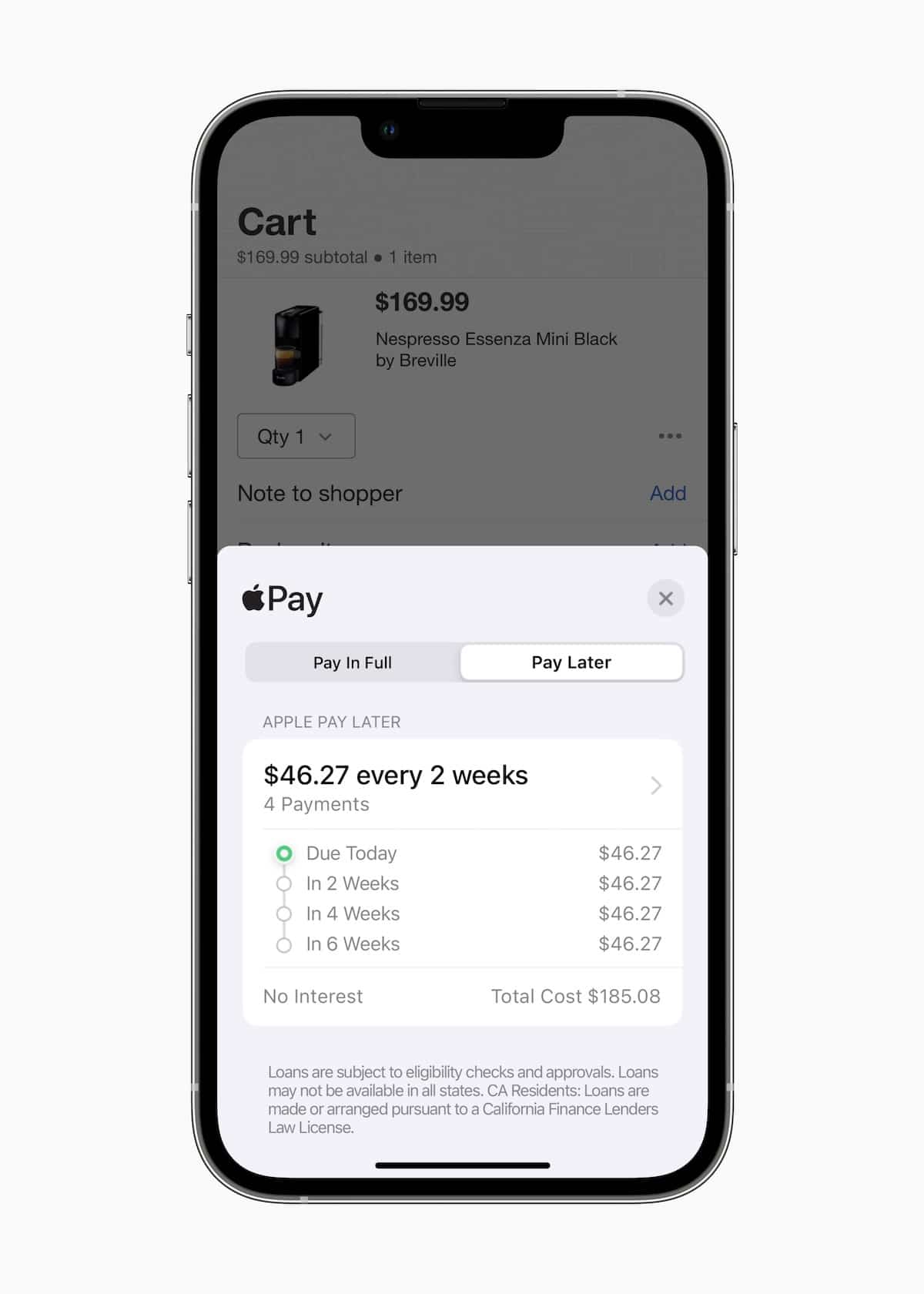

At the WWDC 2022 event, the Cupertino tech giant announced a new “Apple Pay Later” in the upcoming iOS 16 update. Integrated with the Wallet app, the new payment service will allow Apple Pay users to split the cost of purchase into four equal payments spread over six weeks. With zero interest and no additional services fees, users will also be able to easily track their installments and make payments via the Apple Pay Order Tracking feature.

For the first time, Apple will handle financial processing services like risk management, credit checks, and others for Apple Pay Later

Until now, Apple’s financial partners CoreCard Corp., Green Dot Corp., and Goldman Sachs Group Inc. handled landing and credit assessment for its financial services like Apple Card, Apple Pay, and others. Now, the company’s new subsidiary will be responsible for credit checks and decisions on loans for the new payment service.

Financial services help keep users glued to their iPhones. That’s why the company wants greater control over the process, letting it roll out new options more quickly and potentially collect more revenue.

The report states that Apple Pay Later transactions will depend on users’ credit history. Therefore, Goldman Sachs will serve as the issuer of the Mastercard payment credential used to complete Apple Pay Later purchases as Apple Financial does not own a bank charter.

Reportedly, Apple’s push to handle lending itself for Apple Pay Later is part of a long-term plan to introduce new financial services like the iPhone hardware subscription program and bring more elements of financial services in-house because the company has very deep pockets.

Apple has been working to move many elements of its financial services in-house as part of a secret initiative dubbed “Breakout.”

In addition to taking on lending, credit checks and decision-making, Apple is working on its own payment processing engine that may eventually replace CoreCard Corp., Bloomberg reported in March. It’s also working on new customer-service functions, fraud analysis, tools for calculating interest and rewards for other services.

Read More: