On May 2nd, 2024, Apple released its Q2 2024 earnings report. The report showed that the company’s revenue had decreased by 4% compared to the previous year, amounting to $90.8 billion. However, this figure was slightly higher than what analysts had predicted.

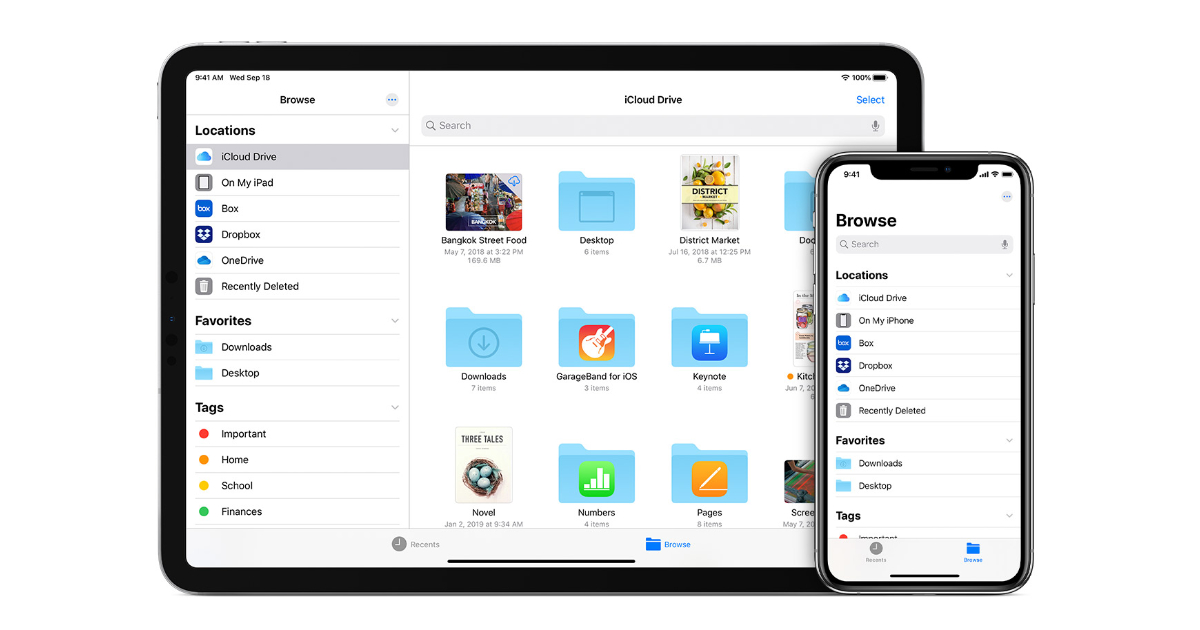

The standout performer of the quarter was Apple’s services segment, with revenue reaching an all-time high of $23.87 billion. This growth can be attributed to the success of Apple Music, iCloud storage, and AppleCare+.

These services have become increasingly popular among Apple users, leading to a more predictable and sustainable revenue stream for the company.

The report also showed a decline in iPhone sales by 10%, with revenue amounting to $45.96 billion. However, this decline can be attributed to the absence of pent-up demand following pandemic-related production delays, which had boosted sales during the previous year’s iPhone 14 launch.

Furthermore, many users have already upgraded to the latest iPhones, leading to longer upgrade cycles. On the other hand, Mac sales increased by 4% to $7.45 billion, thanks to the success of M2-powered MacBooks. However, iPad sales fell by 17%, while wearables and accessories saw a 9.7% dip.

Despite the year-over-year revenue dip, Apple has several reasons to be optimistic:

- Loyal user base: The company boasts a record number of active devices across its product lines, creating a strong foundation for continued growth in the services segment. With millions of users already invested in the Apple ecosystem, the potential for further service adoption remains high.

- Financial: In terms of financials, the company’s position is enviable. They have a substantial cash reserve and recently announced a record $110 billion stock buyback program, showcasing their financial strength and commitment to shareholder value.

While some hardware products might face short-term challenges, upcoming product launches and the company’s unwavering commitment to innovation could potentially reverse these trends in the coming quarter.

Apple remains committed to innovation and navigating the changing market through its strategic shift towards recurring revenue streams, which has proven successful in creating a more stable revenue stream for the company.

Read more: