Apple unveiled next-generation products at the “Unleashed” event on October 18. With a mixed response to the new laptops, wireless headphones, and service plan, financial analysts unanimously predict that the new MacBook Pro models, AirPods 3, and Apple Music Voice Plan will boost the company’s revenue and increase its market share.

The new Pro and M1 Max MacBook Pro models start at $1,999, AirPods 3 retail for $179, and Apple Music Voice Plan has a $4.99 monthly subscription fee. By offering new products at affordable and high prices, analysts believe that the Cupertino tech giant is expanding its products lineup with diverse price ranges to cater to a larger consumer market which will translate into an increase in revenue.

The success of Apple’s new products will achieve a $180 share price for the company by 2022

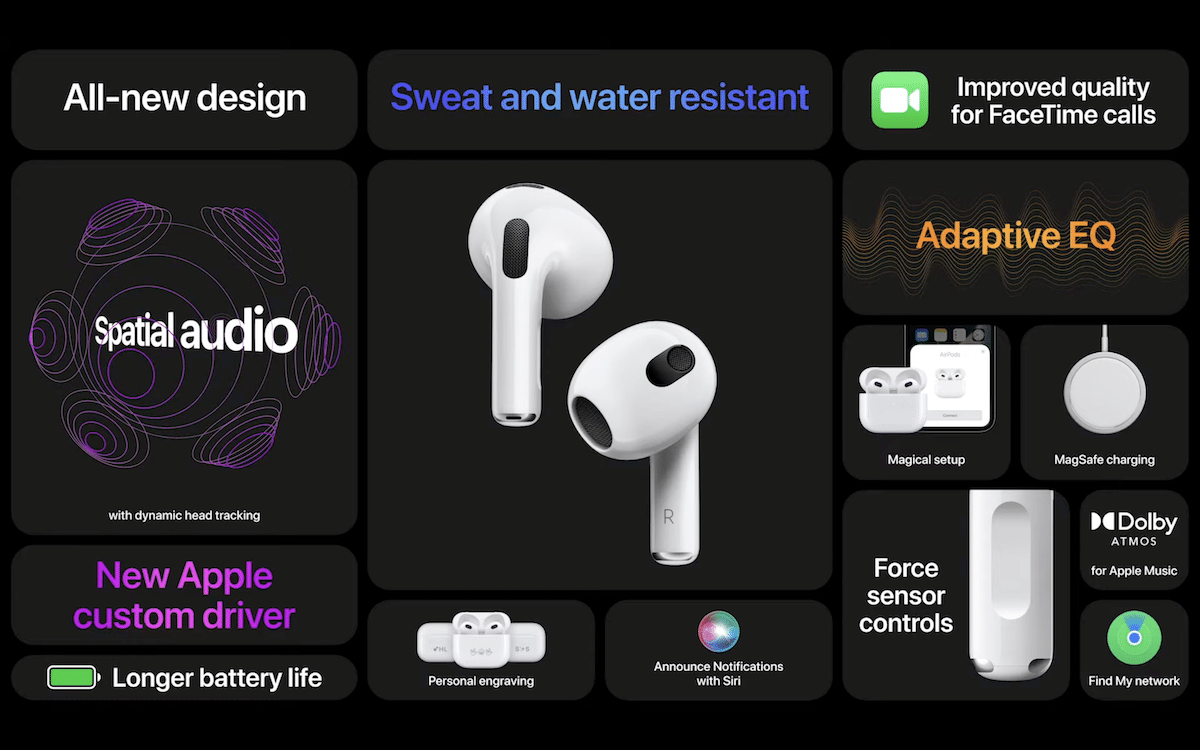

Impressed by the new hardware updates at Unleashed event, Daniel Ives of Wedbush believes the company will have a busy holiday shopping season, in spite of supply chain constraints. With the addition of the new AirPods 3, he estimates that AirPods count accounts for 5% of total revenue with 100 million units sold this year. In addition, the new Mac models powered by Apple Silicon are a game-changer for the company. He maintains that AAPL will hit $185 price in 12-months

Both of these long-anticipated products are likely to catalyze growth in Apple’s hardware segment. Combined with the iPhone 13, the analyst believes that Apple is in the midst of its biggest hardware refresh cycle in a decade with the Oct. 18 event just adding to the tailwinds.

In his new note to investors, Krish Sankar of Cowen & Co. writes that the new MacBook Pro models powered by fast M1 Pro and M1 Max chips will propel Apple to the dominant premium and professional computers market segment and the low-cost Apple Music Voice Plan will expand its music streaming service’s subscription base. He estimates AAPL to hit $180 price in 12-months.

“These new MBPs with M1 silicon will aid AAPL in realizing the 3-5% EPS accretion from moving to in-sourced chips (manufactured at TSMC). We believe the Mac Pro and iMac Pro will be the last of the Mac systems to be transitioned [to Apple Silicon].”

The analyst believes that the M1 Pro and M1 Max chips could drive around a $0.10 incremental upside, resulting in a 3% to 5% earnings-per-share accretion. He expects the MacBook Pro models to bring further product differentiation versus Windows notebooks, and could expand the Mac’s contribution to Apple’s EPS.

Samik Chatterjee of JP Morgan calls the new MacBook Pro and AirPods models an attempt by Apple to slightly change the existing products to drive adoption across a wider price range; Selling for $1,999 to $3,499 price range, the 2021 MacBook Pro are “niche high-end” models but cheaper AirPods 3 and Voice plan “could drive an expansion of Apple’s total market.” He maintains AAPL share price will reach $180 in 12 months.

Cupertino tech giant will publish Q4 2021 earning report on October 28 which will be followed by a conference. The report and conference will give a clear picture of new products’ success with the consumers.

via AppleInsider

Read More:

- Download 2021 M1 Max MacBook Pro wallpapers for any computer

- macOS conceals the notch on new MacBook Pro models when apps are in Full-Screen mode

- AirPods 2 price is reduced to $129 to make the wireless headphones more affordable then ever

- New ‘Monterey’ screen saver in macOS Monterey Release Candidate

- macOS Monterey, iOS 15.1 and watchOS 15.1 to release on October 25