Apple Savings, a long-awaited savings option, is now available to Apple Card users, allowing them to route their Daily Cash rewards into a new high-yield savings account with an annual percentage yield (APY) of 4.15%.

A closer look at Apple Savings: features, benefits, and more

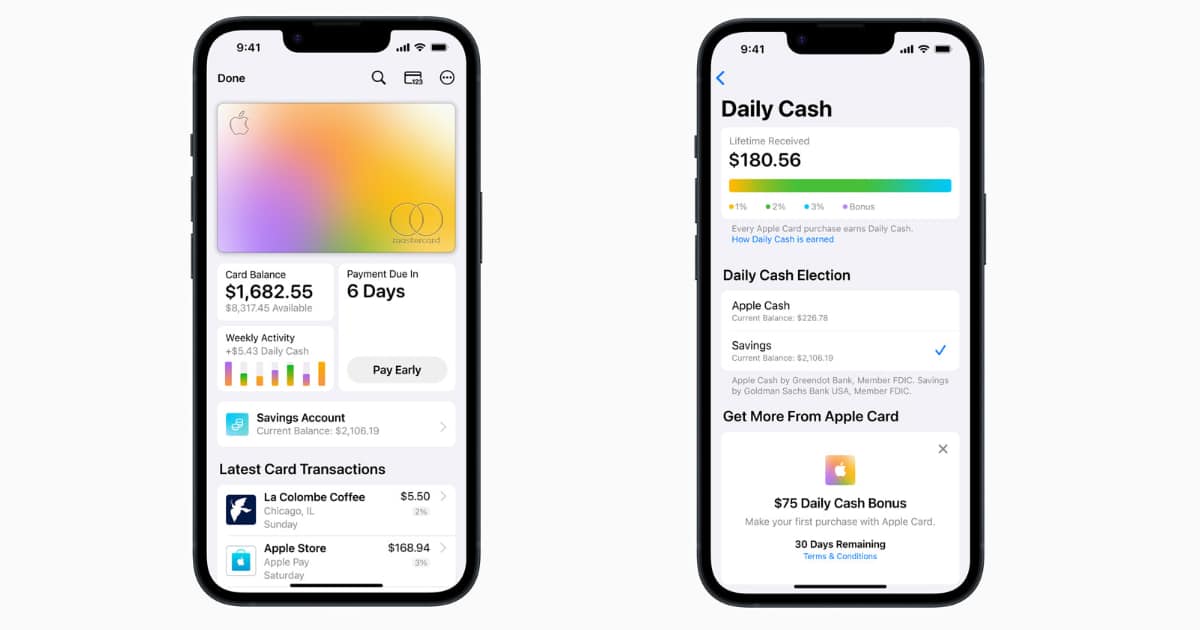

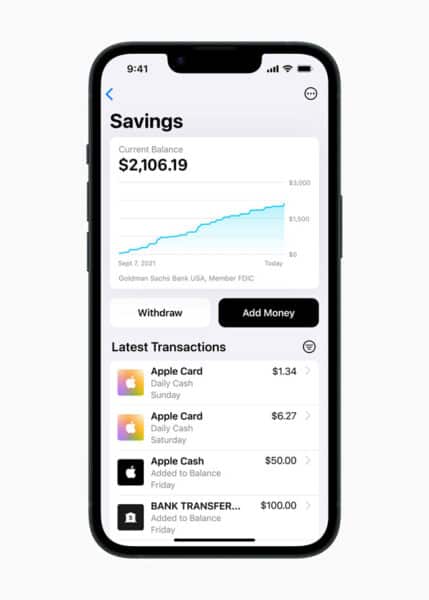

According to Apple, the APY rate is more than 10 times the national average, with no fees, minimum deposits, or minimum balance requirements. The savings account comes with a Savings dashboard in the Wallet app, which enables users to conveniently track their account balance and interest earned over time.

While Fortune magazine recommends ten savings accounts, every one of which offers more than Apple, it notes that APY is not the sole factor in determining the right savings account to invest in. There are also issues to do with minimum deposits, balances, and customer support. Apple Savings is likely to prove particularly strong on customer support, with its Savings dashboard.

The launch of Apple Savings comes after an announcement in October 2022, and then mostly silence since. It’s possible that the service launched so long after the announcement because the finances are being serviced by Goldman Sachs, Apple’s partner in the Apple Card.

Despite the apparent success of Apple Card, Goldman Sachs posted a $1.2 billion loss, which was attributed in part to its consumer offerings such as that with Apple. Consequently, Goldman Sachs recently pulled out of doing any other consumer credit card. Alongside that, the Federal Reserve opened an investigation into whether Goldman Sachs’s consumer credit division has sufficient consumer protections.

Now that Apple Savings is here, users will set it up once and then not have to deal with it until they choose to. Apple Card users continue to get rewards as a percentage of their purchasing, and they can continue to have that go into their existing Daily Cash account. However, if they choose to, those payments can instead go into the new high-yield savings account.

Users will also be able to deposit additional funds into the Apple Savings account through a linked bank account or from their Apple Cash balance. There’s no limit on how much Daily Cash can be earned and saved, plus users can elect to switch off the automatic payment into their Apple Savings account at any time.

In conclusion, Apple Savings is a valuable addition to the Apple Card benefit, providing users with an easy way to save money every day and build healthier financial lives. While there may be other savings accounts with higher APY rates, Apple Savings’ customer support and convenience through the Savings dashboard make it a strong option for Apple Card users.