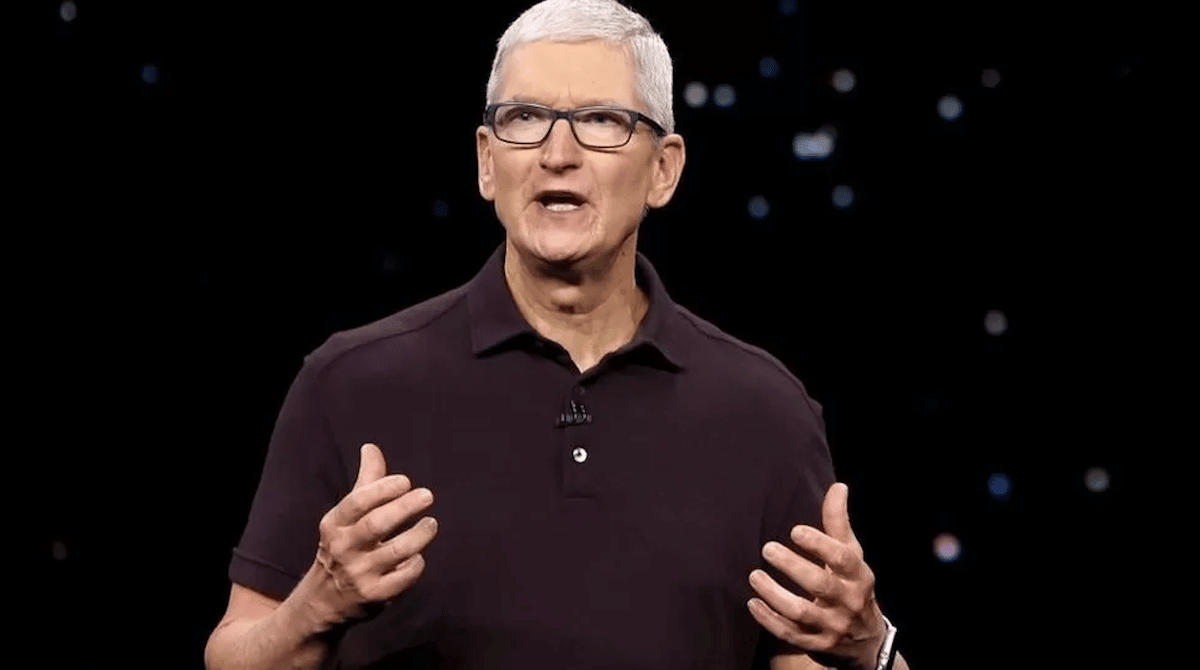

Apple reached a settlement of $490 million with shareholders who alleged that CEO Tim Cook misled investors about iPhone demand in China. This lawsuit has been simmering for several years, raising questions about transparency and corporate accountability.

Apple agreed to pay $490 million to settle the class-action lawsuit

The lawsuit stemmed from a series of events in 2018 when Apple experienced a notable decline in iPhone sales, particularly in key markets. However, critics argued that despite being aware of this downturn, Apple, under the leadership of Tim Cook, failed to adequately disclose this information to shareholders.

As a consequence, shareholders purportedly suffered financial losses as the stock price plunged following the revelation of lower-than-expected iPhone sales figures.

Allegations against Tim Cook

At the center of the lawsuit was the allegation that Tim Cook, in his capacity as CEO, engaged in actions that misled shareholders regarding the true state of iPhone demand.

Critics contended that Cook’s purported failure to disclose crucial information about declining sales amounted to securities fraud, ultimately impacting the company’s stock valuation and investor confidence.

Settlement terms

In a move aimed at resolving the protracted legal dispute, Apple has agreed to a settlement amounting to $490 million. This substantial sum is intended to compensate affected shareholders for their financial losses stemming from the alleged misconduct.

The settlement between Apple and shareholders in the lawsuit alleging shareholder fraud by CEO Tim Cook marks a notable chapter in the company’s history. While the financial implications are substantial, the resolution of this legal dispute provides an opportunity for Apple to refocus its efforts on innovation and growth.

Moving forward, stakeholders will undoubtedly monitor Apple’s corporate governance practices closely, emphasizing the critical role of transparency and integrity in maintaining investor trust.

(Via Reuters)

Read more: