Apple’s new contactless payment service for merchants, Tap to Pay on iPhone is now available to merchants in the United States. Wix has announced its partnership with Stripe which expands the wireless payment service to more merchants through the Wix app on iOS.

Wix is a platform for brands to create, manage and grow their digital presence in a secure way. It offers businesses a variety of commerce and business solutions, SEO and marketing tools, and more to help them build strong relationships with their customers.

Over 700,000 Wix businesses can use Tap to Pay on iPhone in the U.S

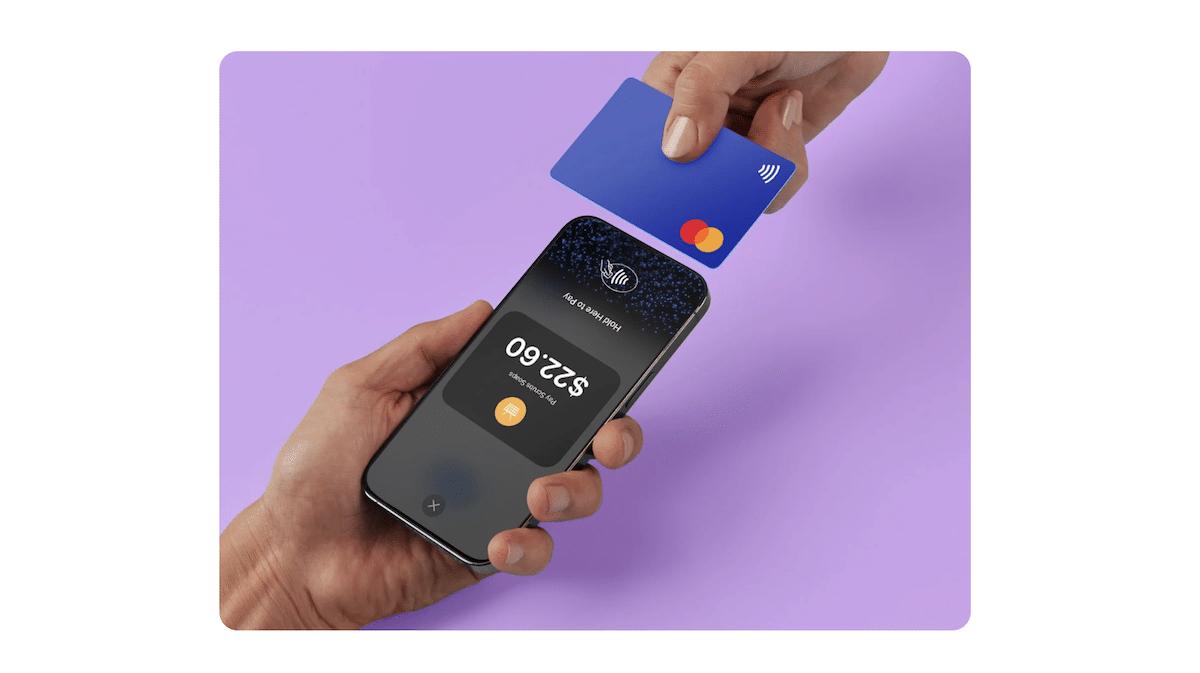

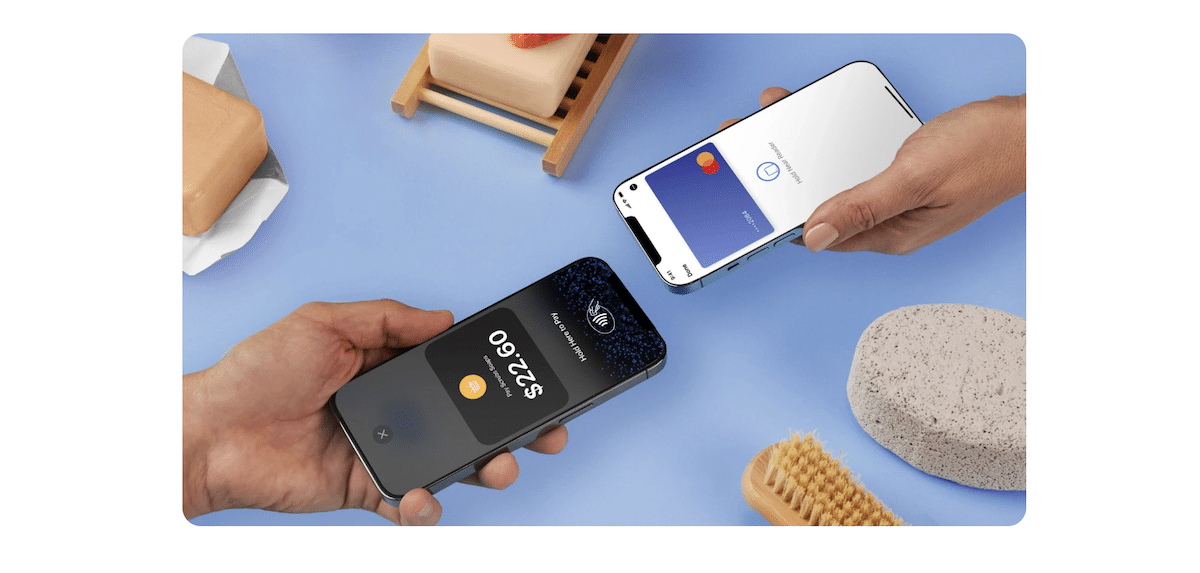

Apple launched the Tap to Pay on iPhone in 2022 across stores in the U.S. The service is based on Near Field Communication (NFC) technology which turns compatible iPhones into payment terminals to accept wireless payment through a single tap of a physical credit or debit card or, Apple Pay or digital wallets. It removes the need for additional hardware

This service is especially beneficial for small businesses which can easily and quickly receive payments through an iPhone and do not have to invest in setting up payment terminals like Block Inc.’s Square required to accept contactless payments that need to be plugged in or have a Bluetooth connection.

Now, US-based Wix merchants can use their Wix app for iOS to accept in-person payments via Tap to Pay on iPhone. Amit Sagiv and Volodymyr Tsukur, Co-Heads of Wix Payments said:

“We’re constantly evolving our solutions to help users efficiently grow both their online and offline sales. Tap to Pay on iPhone offers merchants a reliable and secure payment option to increase customer touchpoints and deliver new in-person experiences, ultimately optimizing their multichannel strategy and increasing the monetization of their offline sales. Our partnership with Stripe gives merchants the ultimate flexibility to sell anytime, anywhere – whether in-store or on the go, at their own convenience to never miss a sale.”

Previously, PayPal added support for Tap to Pay on PayPay and Venmo on iOS and Square.

Read More: