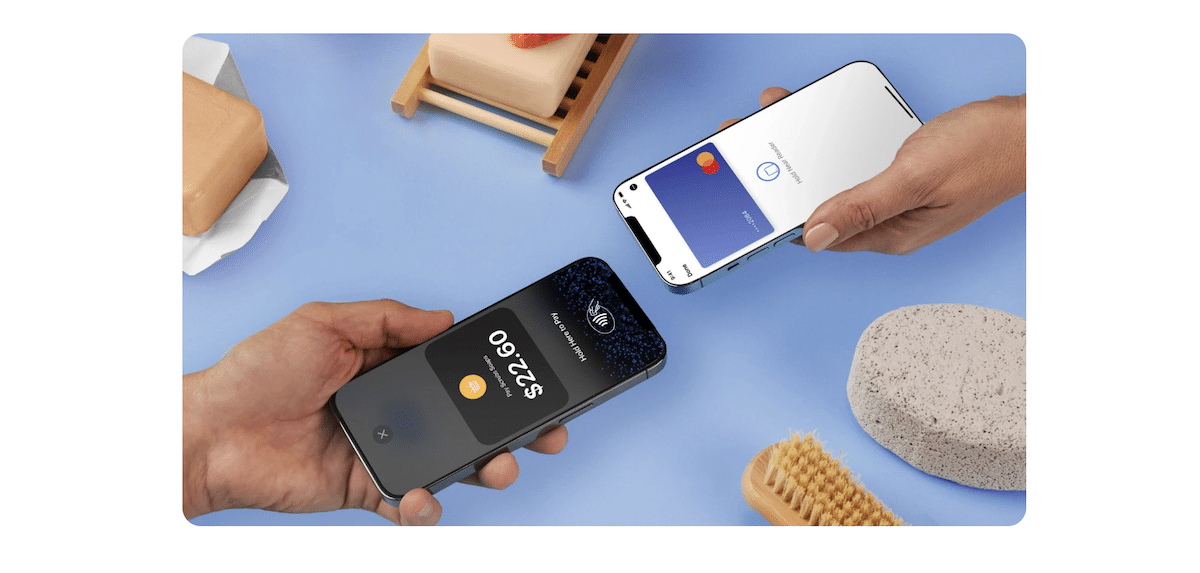

Apple has announced that its latest contactless wireless payment service, Tap to Pay on iPhone is now available across the U.K. Merchants can easily accept payments simply with an iPhone and a supporting iOS app.

The Tap to Pay on iPhone payment service uses the Near Field Communication (NFC) technology in the latest iPhones which turns the smartphone into a payment terminal for cash transactions via a single tap and eliminates the need for any additional hardware or payment terminal like Block Inc. Square which requires to be plugged in or have a Bluetooth connection.

Apple launched the service in the United States in 2022 and later expanded it to Australia this year. Now, it is available in another new country.

Revolut and Tyl first to support Tap to Pay on iPhone in the UK, others coming soon

Merchants from small businesses to large retailers in the UK can now use Tap to Pay on iPhone to accept Apple Pay, contactless credit and debit cards, and other digital wallets through an iPhone and a partner-supported iOS app, including Apple Store locations.

Revolut and Tyl by NatWest are the first payment platforms to support the contactless payment service in the country. Apple says that support from other platforms is coming soon like Zettle by PayPal, Viva Wallet, Worldline, Stripe, SumUp, Adyen, Dojo, and myPOS.

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet said:

“We’ve seen Tap to Pay on iPhone transform the checkout experience for so many different types of businesses, and we’re thrilled to now support merchants across the U.K. by offering an easy, secure, and private way to accept contactless payments using the power, security, and convenience of iPhone, with no additional hardware needed.

Small and medium-sized businesses have long played a vital role in the U.K. economy, and alongside payment platforms, app developers, and payment networks, we’re making it easier than ever for U.K. businesses to seamlessly accept contactless payments and continue to grow their business.”

Tap to Pay on iPhone requires an iPhone Xs or later running the latest iOS version and it is available for payments platforms and developers in the U.K to integrate into their iOS apps.