Counterpoint Research’s latest study of global smartwatch shipments in Q1, 2021 reveals that Apple dominates the market with an impressive 50% Year-on-Year growth. The increase in demand for the new Apple Watch Series 6 helped the company remain on top. With a below-the-market average growth, Samsung’s Galaxy Watch 3 and Active smartwatch shipments grew by 27%. And the shipments of the low-mid range smartwatch models by Huawei continued to drop in numbers.

In 2020, the Cupertino tech giant launched two new models of its smartwatch lineup, high-end Apple Watch Series 6 and mid-range Apple Watch SE. Although both models have the same edge-to-edge design and sizes (40mm and 44mm), they are very different in capabilities and price. Starting at $399, the Apple Watch Series 6 has an Always-On Retina display, and Blood Oxygen and ECG features which are lacking in the Apple Watch SE, retailing for $279. In addition, the company also launched its watch-bound fitness+ subscription service.

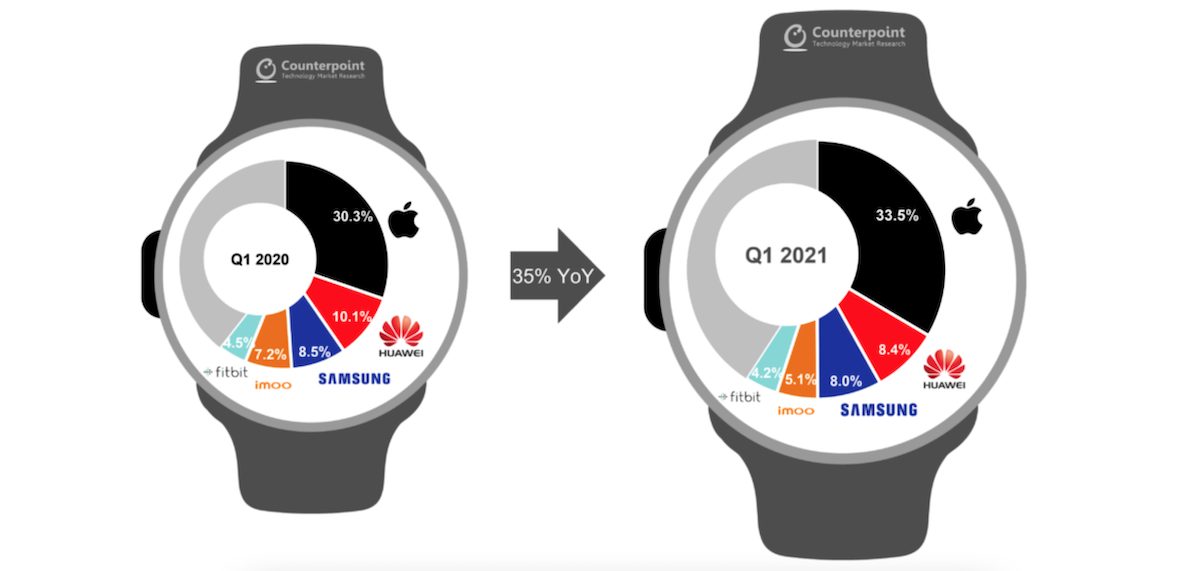

Apple’s value grew by 3% in the global smartwatch market in Q1 2021

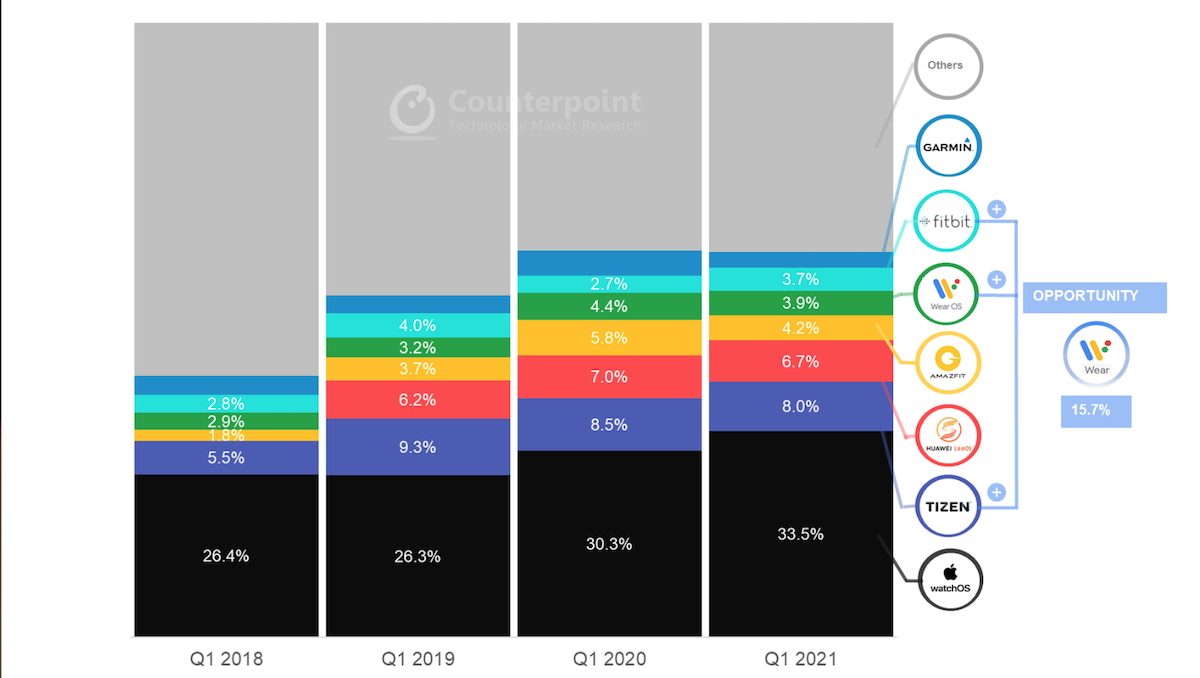

The report details that the global smartwatch shipments grew by 35% in the first quarter of 2021 based on the volume of high-range smartwatches by Apple, Samsung, and Garmin, low-mid range smartwatches by OPPO and Xiaomi, and kids smartwatches by BBK, Vodafone Neo, and Huawei. And thanks to Apple’s operating system, and high-mid range smartwatch models, its global share grew by 3%.

Counterpoint’s Senior Analyst Sujeong Lim said that:

Apple was able to further solidify its leadership position in the market by widening the portfolio from Watch SE to Series 6 at the right time. This may drive Samsung to launch a mid-price-tier model to boost growth.

Liam further explained that the Cupertino tech company’s optimization of its smartwatches for its smartphone has been an attractive feature of over a billion iPhone users. A capability which Apple’s competitors lack for now.

In terms of smartwatch OS platforms, Apple’s WatchOS captured more than a third of the market with a growing attach rate to its base of billion iPhone users. Google’s Wear OS has not yet achieved such success in smartwatches. This is because most of the major smartwatch brands have developed and installed their own proprietary OS (like Fitbit OS, Tizen and Garmin OS). Further, Wear OS has been lacking behind in terms of features, battery optimization and chipset support. This has limited its share to a mere 4% of the global smartwatch market.

As per Vice President Research Neil Shah, the wrist wearable is an “exciting” and important part for tech companies because, with the smartwatch, they can sell various services.

This can include selling services such as Apple Fitness+, predictively cross-selling medicines and healthcare solutions, or attracting marketers to their ad platforms based on the health profiles built with the enormous amount of data generated via the number of sensors on these wearable devices. Further, addition of advanced voice AI and ML capabilities on these devices will make wrist as one of the key segments technology companies will go after this decade before adding eyes/brain-based advanced wearable devices to the mix.”

Despite a slight YoY decline in Q4 2020 due to the COVID-19 pandemic, Apple’s new smartwatch models had good sales. The company shipped 12.9 million Apple Watch Series 6 and SE models increasing its market share by 6%.