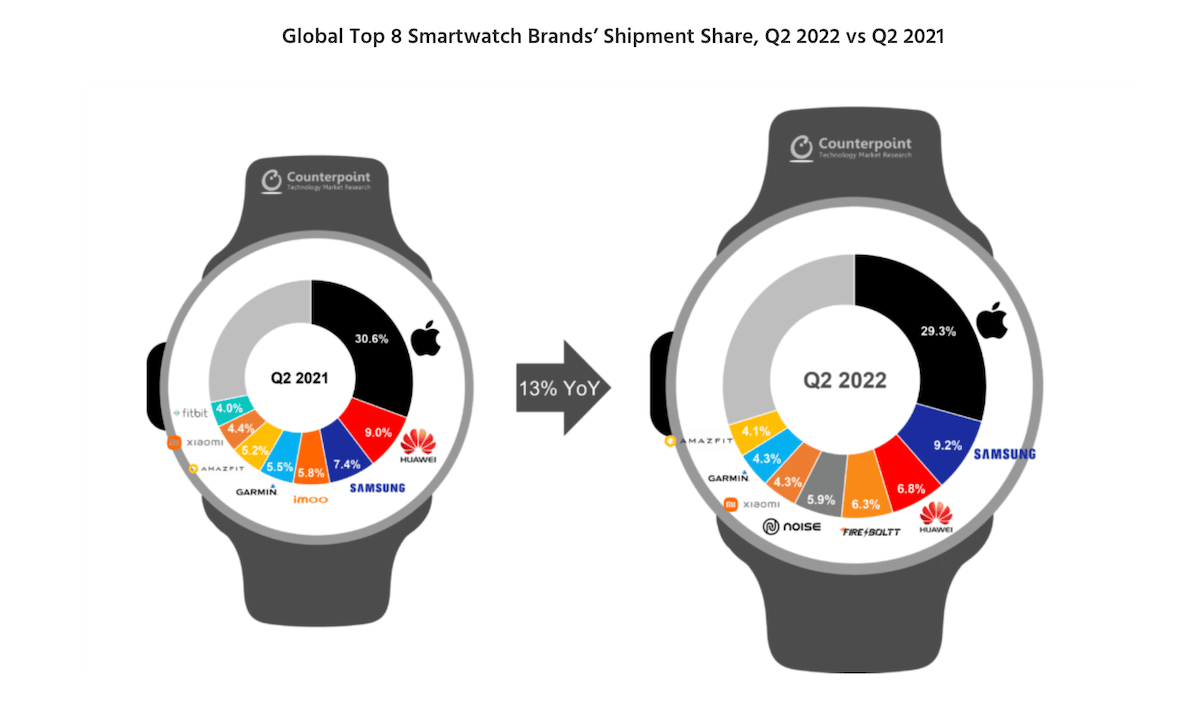

A new survey by Counterpoint research reveals that the global smartwatch market grew by 13% Y-o-Y in Q2, 2022, and Apple Watch dominated the segment by capturing the largest market share.

With a 29.3% market share in Q2, 2022, Apple retained its top spot in the global smartwatch market in spite of macroeconomic deterrents like inflation, and geopolitical issues.

Apple’s shipments increased 8% YoY, taking the top spot in this quarter as well. However, as the effect of the new model launch gradually weakened, the decline in Apple Watch 7 series shipments became larger compared to the previous quarter.

Samsung came in the second spot with 9.2% market share and Huawei captured the third position with 6.8% market share in Q2, 2022.

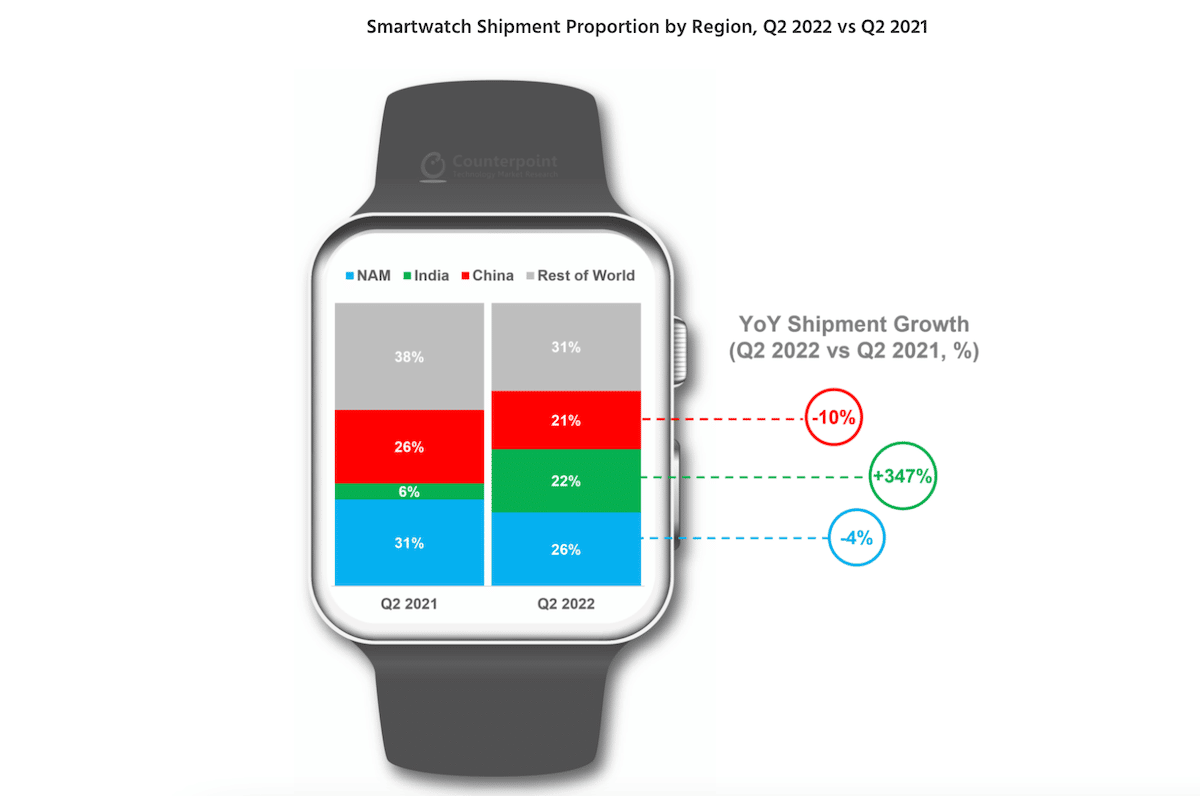

Interestingly, India became the second-largest smartwatch market for the first time. The Indian market saw 300% Y-o-Y growth driven by the strong growth of local brands like Noise and Fire-Boltt who sell Apple Watch clones at the fraction of its price.

Apple Watch clones by Noise and Fire-Boltt boosted the Indian smartwatch market by 300% in Q2, 2022

Earlier this month, we reported that Apple Watch clones from Noise, Fire-Boltt, Helix India, and local OEMs were marketed heavily by Indian celebrities who themselves are Apple Watch users.

Bollywood and sports stars like Virat Kholi, Karan Johar, Kareena Kapoor, Sania Mirza, and Shilpa Shetty are a few names who have partnered with either Fire-Boltt or Noise to promote the low-end smartwatches and it has paid off for the brands.

Fire-Boltt recorded a remarkable increase in shipments, taking first place in India’s market in terms of quarterly shipments.

Noise grew 298% YoY, gaining popularity in both online and offline markets of India. However, due to the rapid growth of Fire-Boltt, it lost the No. 1 position in the Indian market with a 26% share.

With its over one billion population, India is an attractive consumer market for low to mid-range products.

By region, North America continued to occupy the top spot, but its gap with the second spot narrowed somewhat.

A notable market for the quarter was India, which grew 347% YoY to overtake China for the second spot. Associate Director Sujeong Lim said, “During the quarter, 30% of models shipped in the Indian market sold for less than $50, and major local brands launched cost-effective models, lowering the entry barriers for consumers.”

Even premium products are doing well in India. Apple accredited the impressive iPhone’s $40.7 billion revenue record in Q3, 2022 to the iPhone 13s strong demand worldwide, especially in emerging markets like Brazil, India, Vietnam, and Indonesia.