Goldman Sachs’ partnership with Apple for the Apple Card, initially set to last until 2030, is now facing an uncertain future. CEO David Solomon has signaled a possible early termination of the collaboration due to substantial financial losses and regulatory hurdles, raising questions about the trajectory of Apple’s first credit card venture.

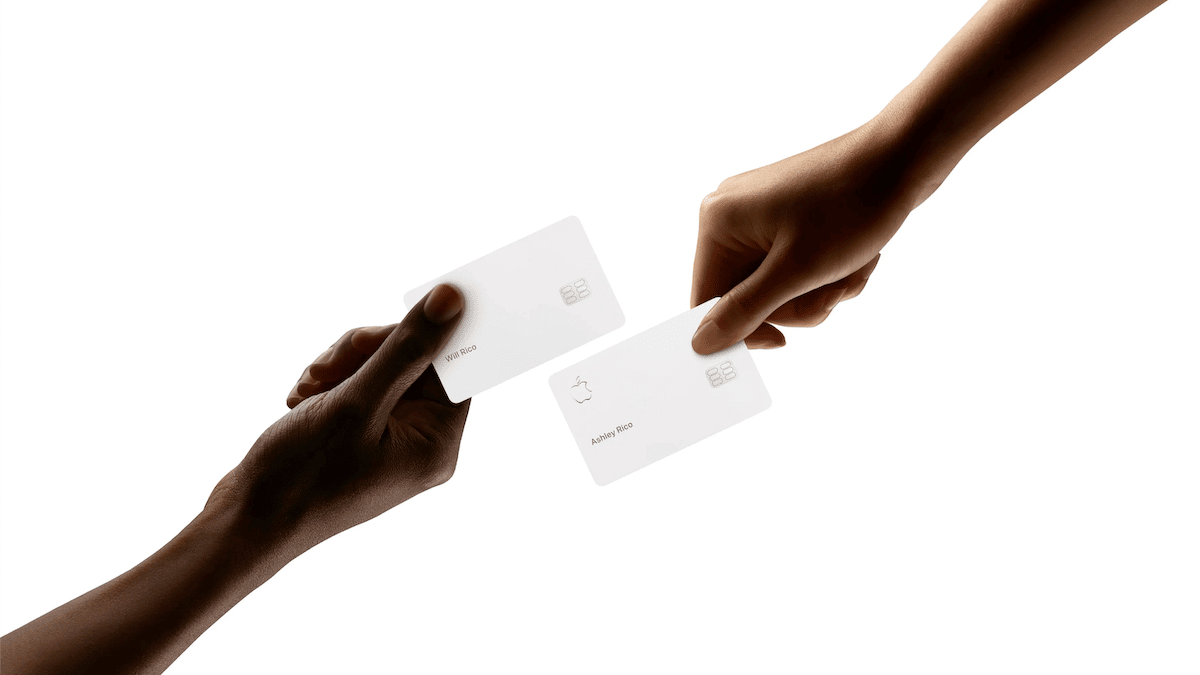

Launched in 2019, the Apple Card was envisioned as a seamless integration into Apple’s ecosystem, offering features like no fees, enhanced privacy, and a user-friendly interface within the Wallet app. While it quickly became popular among Apple users, the financial burden on Goldman Sachs has been significant. The bank reported losses of $1.2 billion from the Apple Card in 2022, with its platform solutions unit posting an $859 million net loss in 2024. The strain on the company’s financials has also impacted its return on equity, reducing it by 75 to 100 basis points in 2023.

Beyond financial difficulties, regulatory issues have further complicated the partnership. In October 2024, the U.S. Consumer Financial Protection Bureau fined Goldman Sachs over $90 million for missteps related to the Apple Card. Investigations revealed billing errors, delays in resolving disputes, and non-compliance with the Fair Credit Billing Act, all of which tarnished the reputation of both Goldman Sachs and Apple’s financial services.

Faced with these challenges, Goldman Sachs has explored transferring its role as the Apple Card issuer. Discussions reportedly began in 2023, with JPMorgan Chase emerging as a potential replacement. Although talks have progressed, no successor has been confirmed. The transition is further complicated by contractual obligations, such as the Apple Card’s required use of the Mastercard network until 2026.

For Apple, finding a new banking partner is essential not only for the Apple Card but also for Apple Savings, a high-yield savings account launched in 2023. Currently backed by Goldman Sachs, the account allows users to deposit Daily Cash rewards and funds from linked bank accounts. A transition to a new partner like JPMorgan Chase could necessitate significant adjustments to the account’s infrastructure, potentially disrupting features like Daily Cash deposits and impacting user satisfaction.

While the Apple Card remains a compelling product within Apple’s ecosystem, its future hinges on securing a partner that aligns with Apple’s customer-first philosophy. As discussions continue, both companies face the challenge of navigating the intersection of tech innovation and the heavily regulated financial sector.