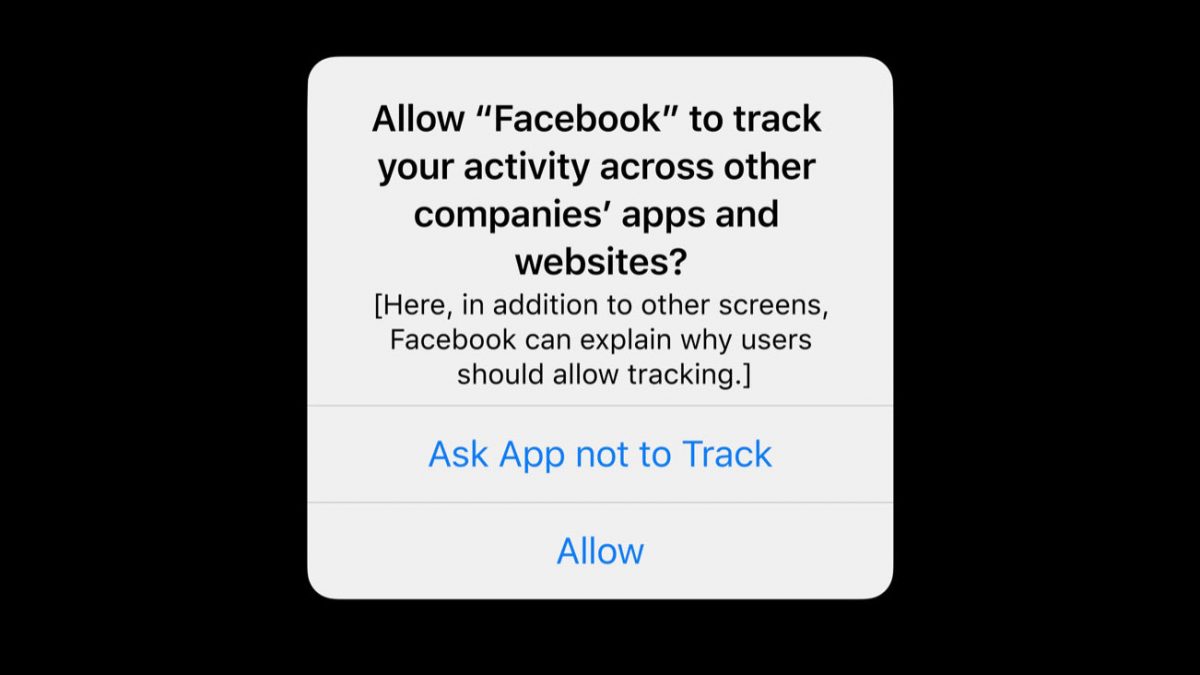

In iOS14.5, Apple finally launched the new App Tracking Transparency (ATT) privacy feature which is designed to give users more control over their data and privacy. By mandating developers to seek users’ permission to track their activity across third-party apps and websites, Apple disturbed the invasive tracking practices of digital advertisers and data brokers to gather information for the proposed of running targeted ads.

Over a year after its release, Apple’s App Tracking Transparency feature has impacted different companies differently. Wall Street Journal reports that Google and Twitter are beneficiaries of the ATT feature, while Facebook and Snapchat Inc. lose a major chunk of their ad revenue. The difference in companies’ ad search data collection models determined the impact of ATT on their platforms.

Apple’s App Tracking Transparency privacy feature hit the ad revenue of Facebook and Snapchat Inc. really hard

As per the report, the digital advertisement market has grown this year with global spending on track to increase 26%, up from earlier projections of 15%, according to GroupM, an ad-buying agency. And much of that business is now going to Google.

Google’s search ad algorithm relies on customer intent, unlike Facebook and Snapchat which rely on data collected via app and web tracking to show targeted ads. Therefore, several e-commerce companies are sending less on targeted-ad platforms.

A dozen e-commerce companies interviewed by The Wall Street Journal said they now have to spend a lot more money on these ads to get the same number of sales from them that they could expect before the new feature was rolled out. They also can’t get enough data to know how effective these ads are at driving purchases. Many have reduced their ad spending on targeted-ad platforms. In a July poll of 118 e-commerce store owners by eCommerceFuel, 62% said they had decreased their Facebook ad spending since the iOS upgrade.

Mark Wagman, managing director at ad-consulting firm MediaLink believes that Google will “gain some of the performance dollars flowing out of some of these other platforms. But that’s not necessarily a durable difference. Google’s data was superior to Facebook’s for the purposes of dealing with the changes that iOS has brought.”

Moreover, Twitter has a brand advertising business model which is designed to improve a brand’s image instead of pushing for a direct sale. That’s why Twitter was not impacted by the App Tracking Transparency feature because “marketers don’t expect it to immediately translate into quantifiable sales and don’t rely heavily on measuring an ad’s effectiveness to decide whether it is worthwhile.”

Facebook and Snapchat Inc, on the other hand, reported ad revenue as a headwind of Apple’s ATT privacy feature. The report states:

Overall, Google brought in $53.13 billion in ad sales in the quarter ended Sept. 30, compared with $28.28 billion for Facebook and $1.1 billion for Snap. Google said Apple’s privacy moves had a modest impact on the revenue of YouTube, its video platform. Twitter Inc., meanwhile, on Tuesday posted ad sales of $1.14 billion, up 41% from a year earlier—a sign the company had largely dodged the ad-market turmoil caused by Apple’s privacy changes. Twitter finance chief Ned Segal said Apple’s privacy moves had been “less of a factor” for the company, compared with Snap and Facebook.

Read more: