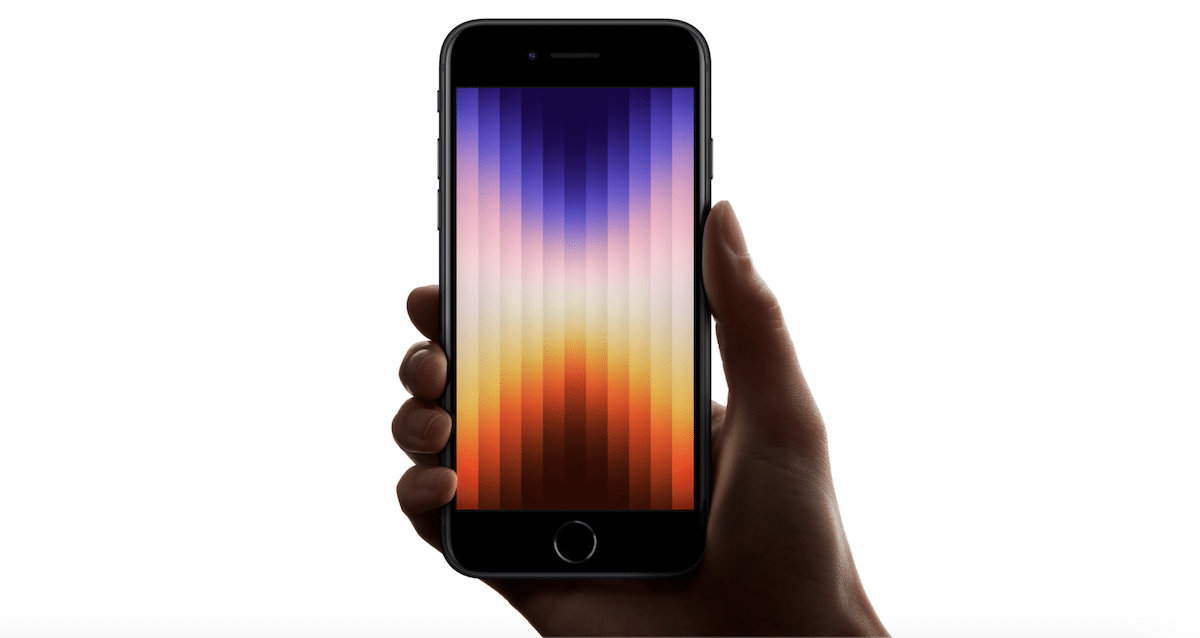

In March, Apple launched the third-generation iPhone SE 2022 with a powerful A15 Bionic chip, 5G connectivity, and an improved camera system but with the same 4.7-inch display and design language as iPhone SE 2020. The new iPhone SE 2022 has not been successful which has made JP Morgan analyst, Samik Chatterjee revise his earnings forecasts for Apple in Q2, 2022.

In his new note to investors, Chatterjee wrote that reduced consumer spending has acted as a “headwind” for Apple’s new iPhone SE model which could impact the company’s iPhone 13 and App Store revenue.

High demand for Apple’s premium products will mitigate the impact of the iPhone SE 2022 and App Store’s weak sales

At the time of launch, it was expected that iPhone SE 2022 with its advanced features and pocket-friendly price will attract a ton of consumers and Apple was estimated to ship 30 million units of the new budget phone. However, by March it was reported that Apple has cut iPhone SE 2022 production by 20% because of weak demand.

Based on the current trends, Chatterjee says that his firm has taken a more cautious view of consumer spending in the wake of waning demand in the electronics segment. For 2022, the analyst has reduced the iPhone SE 2022 estimated shipments from 30 million to 24 million, and reduced iPhone shipments from 250 million to 245 million.

Furthermore, based on the lower number of new downloads, and gaming and total revenue, Chatterjee also predicts that consumers’ low spending on the App Store could also impact the growth of Apple Service by up to 20%. He has revised his growth forecast for the smartphone market because the poor performance of the new iPhone SE could also impact iPhone 13 and App Store performance.

Having said that, Chatterjee also mentions that Apple is well equipped to absorb iPhone SE 2022 headwind. The companys’ premium products like iPhone 13 Pro, iPad, and MacBook models will make up for the lost revenue and Apple’s share value is likely to increase.

“Thus, we are trimming our earnings forecasts for Apple, led by a modest haircut to our revenue growth estimates for iPhone (primarily iPhone SE) and Services, although the overall reduction in estimates is fairly modest given the resilience of high-end smartphones, tablets and laptops to the broader slowdown in consumer spending,” Chatterjee writes.

Despite the headwinds, Chatterjee still believes that Apple “should drive offsets through market share increases.” He says Apple is still well-positioned to still deliver resilient performance in product revenue growth because of market share gains.

Chatterjee is maintaining his 12-month Apple price target of $210, which is based on a profit-to-earnings multiple of 30x and a calendar year earnings estimate of $6.90.

Apple will publish its Q2, 2022 earning report on April 28 which will include the performance of the new iPhone SE, Studio Mac, and Studio Display, along with existing products.

via Apple Insider

Read More: