Smartphone shipments suffered an 18.3% largest-ever decline in the fourth quarter of 2022. In spite of a reduction in iPhone shipments, Apple performed better than competitor in the same quarter according to International Data Corporation (IDC).

In September 2022, Apple launched iPhone 14 series and the iPhone 14 Pro models were an instant hit with consumers. Both iPhone 14 Pro and iPhone 14 Pro Max models saw the highest demand. Unfortunately, Apple faced supply constraints right before the Holiday season because of production challenges in China.

Apple’s iPhone 14 Pro exclusive assembly partner, Foxconn had a COVID-19 breakout at its largest iPhone manufacturing plant in Zhengzhou, China, and faced riots and protests by workers which led to a further reduction in iPhone 14 Pro shipments and impacted Apple’s iPhone sales in Q4, 2022.

iPhone shipments fell by 14.9% as a result of China’s zero-COVID policy in 2022

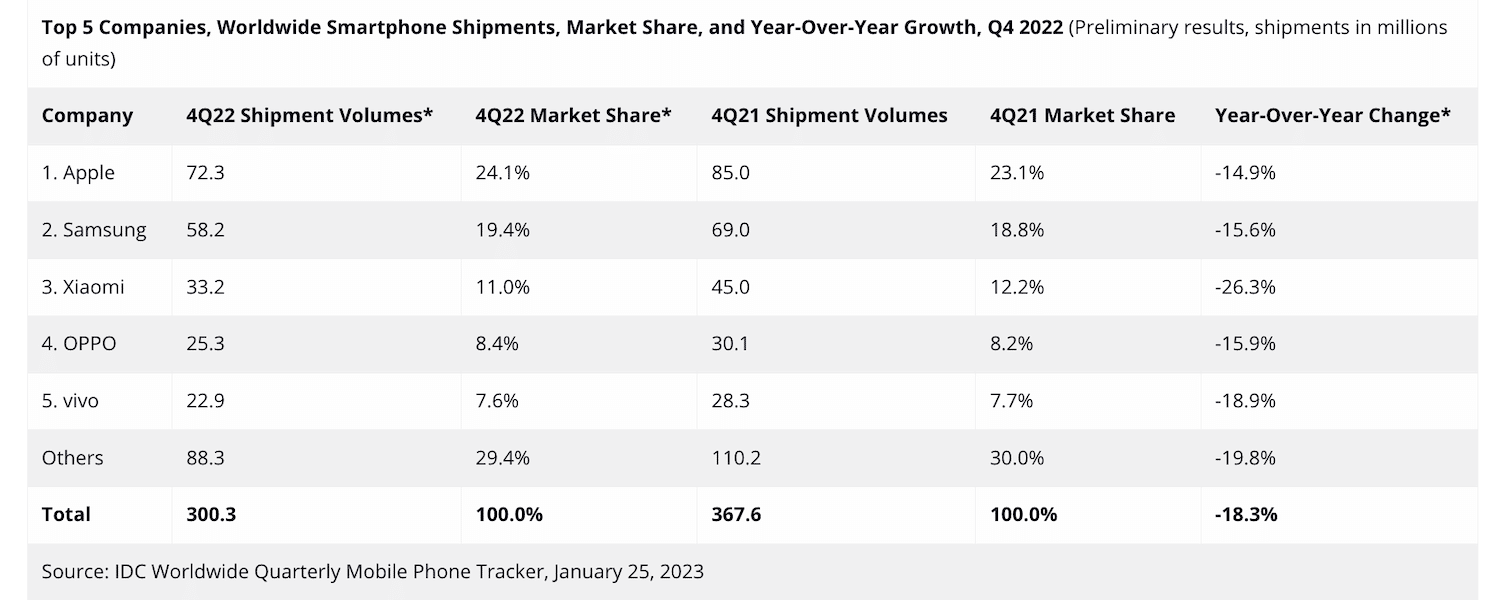

As per the data, Apple saw a 14.9% Y-o-Y decline in Q4, 2022 but still dominated that global smartphone market share. It rivals saw bigger decline in smartphone shipments in Q4, 2022:

- Xiaomi shipments declined by 26.3%

- Samsung shipments declined by 15.6%

- Oppo shipments declined by 15.9%

Research director at IDC Worldwide Tracker team, Nabila Popal said that the smartphone market experienced the largest-ever decline in the holiday quarter of 2022 because of weak demand and a surplus of inventory,

“We have never seen shipments in the holiday quarter come in lower than the previous quarter. However, weakened demand and high inventory caused vendors to cut back drastically on shipments. Heavy sales and promotions during the quarter helped deplete existing inventory rather than drive shipment growth. Vendors are increasingly cautious in their shipments and planning while realigning their focus on profitability.

She also explained that Apple also faced the burnt of a declining market because of COVID-19 lockdowns in China and macroeconomic conditions. However, the market is expected to improve by the end of this year.

Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China. What this holiday quarter tells us is that rising inflation and growing macro concerns continue to stunt consumer spending even more than expected and push out any possible recovery to the very end of 2023.”