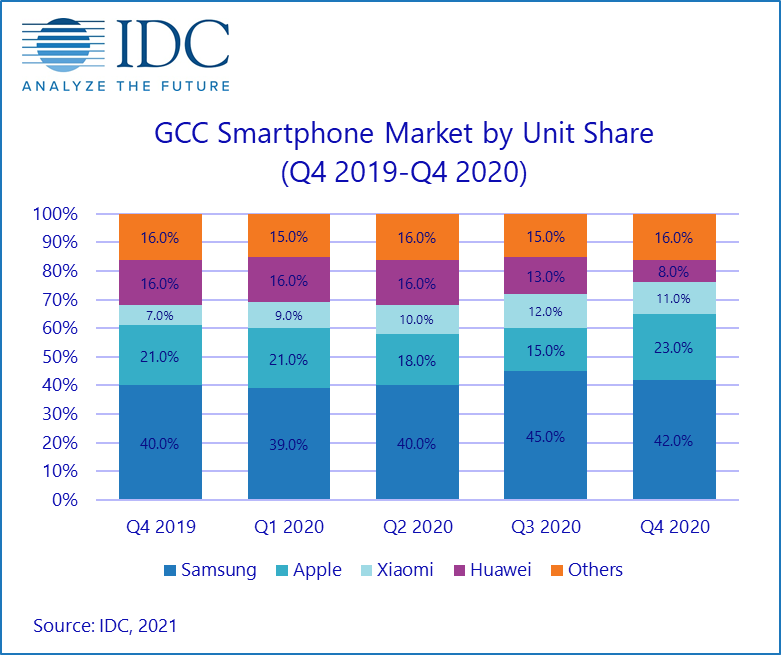

As per research from International Data Corporation (IDC), following Apple’s iPhone 12 launch, the company witnessed double-digit growth in Q4 2020 in Gulf countries, which includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

According to the report, the mobile phone market of the Gulf Cooperation Council region experienced quarter-on-quarter growth of 8.2% in Q4 2020 to a total of 5.38 million units. Smartphone shipments grew 2.3% QoQ to 4.26 million units, while feature phone shipments increased 38.3% to a total of 1.12 million units. In terms of value, the smartphone market totaled $1.62 billion in Q4 2020, up 39.5% QoQ. The feature phone market’s value grew 22.2% over the same period to reach $19.2 million.

iPhone shipments saw 55% QoQ increase in Q4 2020 in Gulf countries

“Apple enjoyed strong demand for the iPhone 12 series in Q4 2020, while its iPhone 11 series continued to perform well in the region,” says Akash Balachandran, a senior research analyst at IDC. “Shortages in the supply of both the iPhone 12 and certain other models curtailed the maximum growth we could have seen from Apple in Q4 2020.”

As per the data collected by the research firm, Saudi Arabia accounted for 49.4% of all smartphones shipped within the GCC region in Q4 2020. However, the country underwent an overall QoQ drop in shipments, with component shortages affecting the lower-end devices of Android vendors. The United Arab Emirates accounted for 26.1% of the region’s smartphone shipments and experienced QoQ growth from Apple’s new releases and mid-tier smartphones from Samsung, Oppo, and Vivo.

Samsung saw shortages of a few key models, which lead to a QoQ decline in shipments of 4.1%. The bulk of Samsung’s offerings are made up of low to mid-range smartphones, leading to a decline in the vendor’s overall value share. Supply shortages led to an insignificant 0.9% QoQ decline in shipments for Xiamoi. The company came in at third in both units and value after Samsung and Apple.

For Q1 2020, the GCC smartphone market is forecast to experience a minor 0.7% QoQ decline in shipments. “Supply constraints will likely continue to hamper growth in the region due to chipset and component shortages across most smartphone brands in the first half year,” says Ramazan Yavuz, a senior research manager at IDC. “However, with supply returning to normal and with the vaccine rollout expected to significantly reduce the possibility of additional lockdowns and spikes in COVID-19 cases, the market is set to see growth return toward the second half of the year.”

Read Also: