Taiwanese Semiconductor Manufacturing Company (TSMC) is engaged in expanding its global manufacturing footprint in the United States, Japan, and China to meet the growing demand of major clients like Apple, Sony, Intel, and others. Detailing the manufacturer’s expansion in Japan at investors call, CEO of TSMC C.C. Wei, confirmed that the company’s $12 billion factory in Arizona will start mass production in the first quarter of 2024.

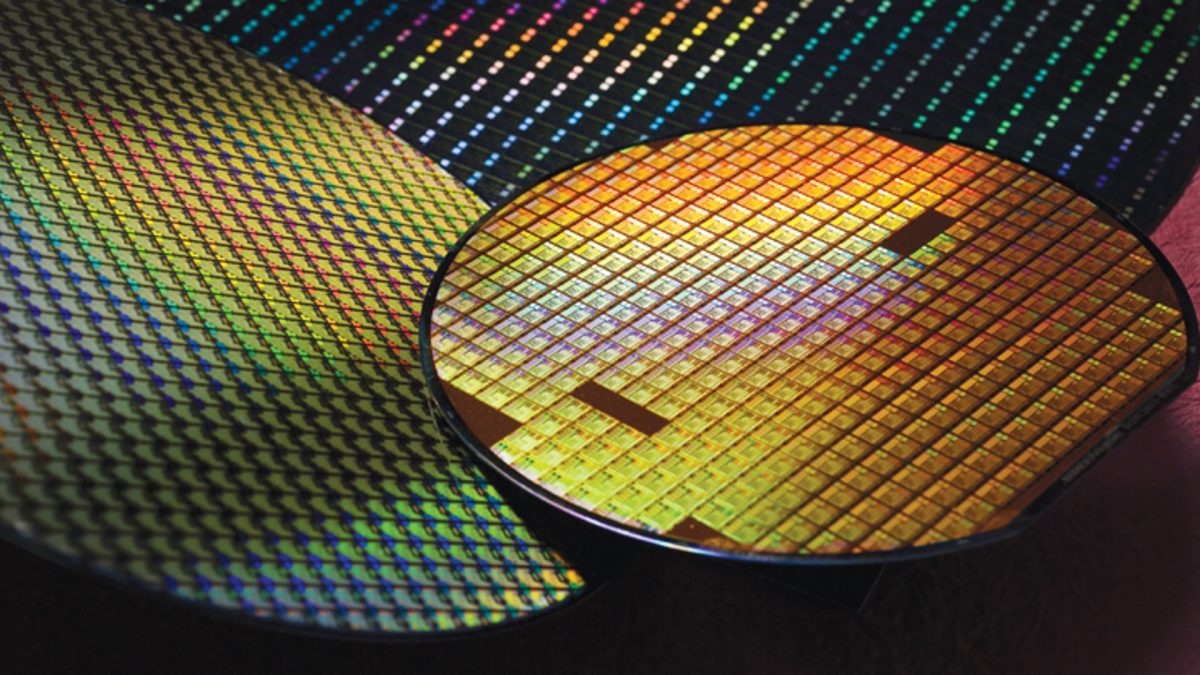

TSMC has been able to meet its clients’ demand, despite the global chip shortage. The manufacturer is Apple’s major silicon supplier who produced the A14 Bionic chip for iPhone 12 series and M1 Apple Silicon for the new Macs and 2021 iPad Pro. Both chipsets are built on an advanced 5nm process which is only produced by TSMC, no other foundry in the world builds chips on 5nm process yet.

TSMC assures Washington of stability in Taiwan ahead of the launch of its Arizona factory in 2024

This market position has been very lucrative for the manufacturer, TSMC reported $13.3 billion in revenue with 20% growth in Q2 2021. Reports claim that the manufacturer is working on chips built on 4nm process and 3nm process which will be used by Apple in future products for faster performance and enhanced battery life.

Therefore, TSMC de-centralizing chip manufacturing from Taiwan by establishing off-shore manufacturing facilities like the $12 billion factory in Arizona, U.S. As reported by Nikkei Asia, Liu said;

“As the need for semiconductor infrastructure security has increased in recent years, we are expanding our global manufacturing footprint to sustain and enhance our competitive advantages, and to better serve our customers in the new geopolitical environment,” Liu told an investors call on Thursday.

Liu confirmed for the first time that the $12 billion factory that TSMC is building in Arizona will start mass production in the first quarter of 2024, and said the first batch of engineers hired in the U.S. to staff the facility arrived in Taiwan during late April for training.

Addressing U.S. political stability concerns about Taiwan, Liu added that all stakeholders support peace in the region because they support a smooth semiconductor supply chain.

Washington pointed out in a recent supply chain review that the centralization of advanced chip production in Taiwan — a key Asian chip economy that China views as part of its territory — is a potential vulnerability for the semiconductor supply chain.

“Let me tell you … everybody wants to have a peaceful Taiwan Strait. And not only because it is to every country’s benefit, but also because of the semiconductor supply chain in Taiwan. No one wants to disrupt it,” Liu said in an apparent attempt to allay investor concerns over geopolitical risks.