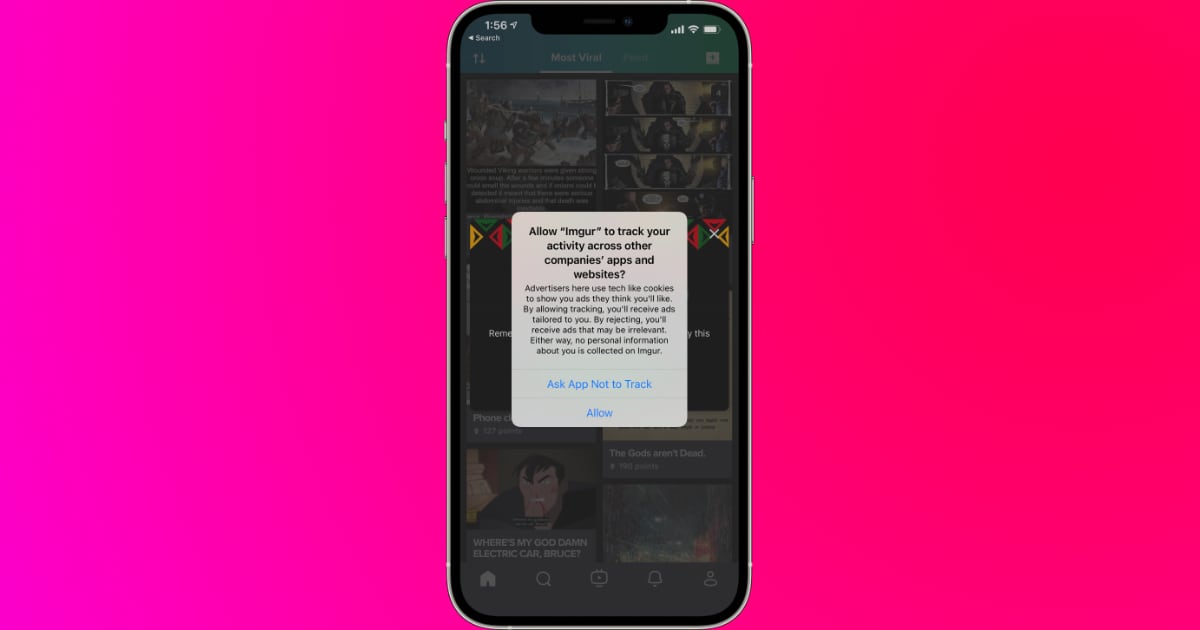

Fortunately, the ATT feature had a reverse impact on Twitter and Snapchat, both apps’ reported high ATT opt-in rates and high Y-o-Y revenue. Apple launched ATT (App Tracking Transparency) feature on iOS 14.5 update which restricts the apps’ capability to track iPhone users across third-party apps and websites and was expected to adversely impact developers’ personalized ad revenues.

Apple new ATT privacy feature did not have a negative impact on digital advertising

CNBC reported Twitter’s and Snapchat’s revenue growth for Q2 2021 with more than 5% growth for each. Here are the details.

Twitter’s Q2 2021 revenue

The social media platform reported $1.19 billion in revenue with 74% Y-o-Y growth and 206 million Monetizable daily active users (mDAUs) in the second quarter of 2021. iOS 14.5’s ATT feature did not result in a loss of revenue for Twitter, instead, advertising on the platform grew by 11%. The report writes:

The number of monetizable daily active users, or Twitter users who view advertising on the site, grew by 11%. The impact from changes in Apple’s iOS 14.5 release associated with tracking were lower than expected.

Snapchat Q2 2021 revenue

The popular video-sharing app recorded higher than expected earnings, revenue, and growth for the second quarter of 2021. Snap Inc. recorded $982 million in revenue which has drastically reduced the company’s net loss by 53%, from $325 million to $152 million. The app reported a 5% increase with 293 million Global daily active users (DAUs).

As per the report, Snap Inc said it was not impacted by the ATT privacy feature because Apple gave developers time to make the required adjustments to new app tracking changes. However, the company also expressed caution that the impact might be experienced later. Jeremi Gorman, Snap’s chief business officer, said:

“Snap said the company was not impacted by Apple’s iOS 14.5 privacy changes as it had anticipated that it would be. This was due to the mobile operating system update rolling out later than expected, iOS users being slow to update their devices and Snap observing “higher opt-in rates than we are seeing reported generally across the industry, which we believe is due in part to the trust our community has in our products and our business.

This has given us more time with advertisers to navigate the transition but also means the effects of these changes will come later than we initially expected.”

CNBC also detailed that other digital advertisers also recorded growth in their Q2 earnings report; “advertising-heavy Facebook rose 2%, while Google parent Alphabet went up 1%.” This highlights that the hew and cry over the loss of revenue with the ATT opt-in feature were baseless.

1 comment